West River Berhad - Upside of 43.6%

Future Plans for Growth:

- Expansion of manufacturing and warehousing capacity.

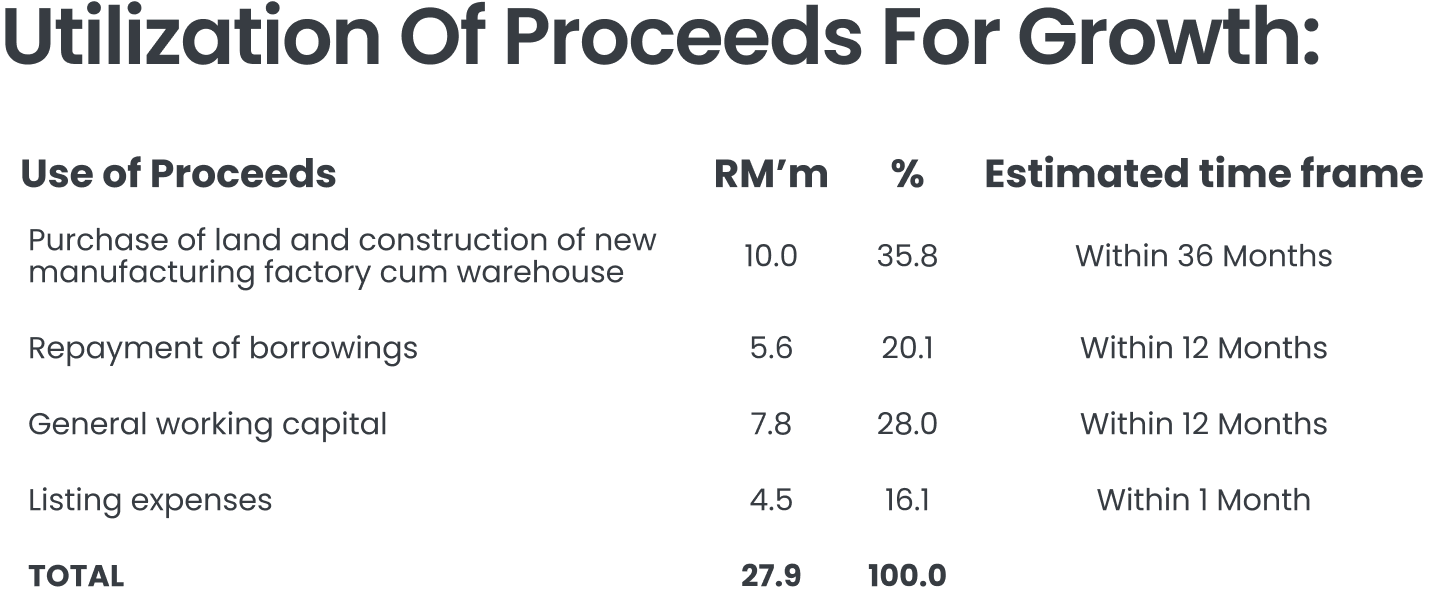

The Group plans to allocate RM10.0m (35.8% of IPO proceeds) to build a new 35,000 sq ft manufacturing facility cum warehouse in the Klang Valley to increase production of electrical panels and distribution boards. The expansion aims to triple current capacity over three years, ease space constraints at the existing 2,088 sq ft facility, and support rising project demand. The new space will also improve inventory management and reduce reliance on third-party suppliers, while a dedicated business development team that will drive external sales opportunities.

- Expanding business development team to drive project wins.

The group plans to strengthen its business development capabilities by hiring three additional personnel—a manager and two executives—to support lead generation, proposal preparation, and client engagement. This expansion will enable the group to scale its outreach efforts beyond the founders, positioning it to capture more project opportunities across M&E engineering and intelligent building solutions. RM0.2m (0.7% of IPO proceeds) will be allocated for the expansion.

M+ Fair Value

We assign a fair value of RM0.56 per share for WESTRVR, representing a 43.6% upside from the IPO price of RM0.39. This valuation is based on a P/E ratio of 15.0x, pegged to mid-FY26f EPS of 3.75 sen. We believe the ascribed P/E is fair as the peer average P/E and forward P/E ratio stood at 11.0-15.7x.