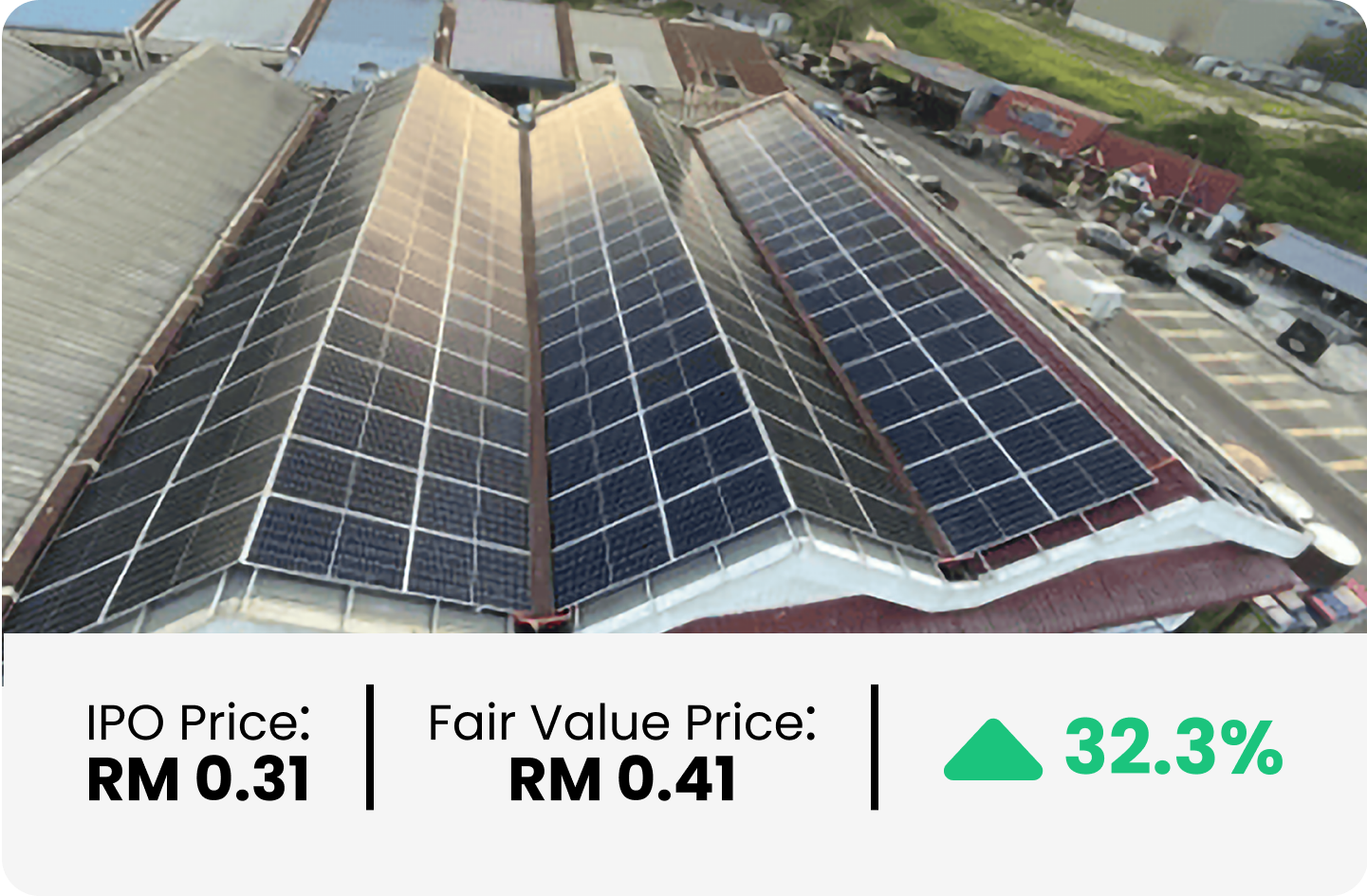

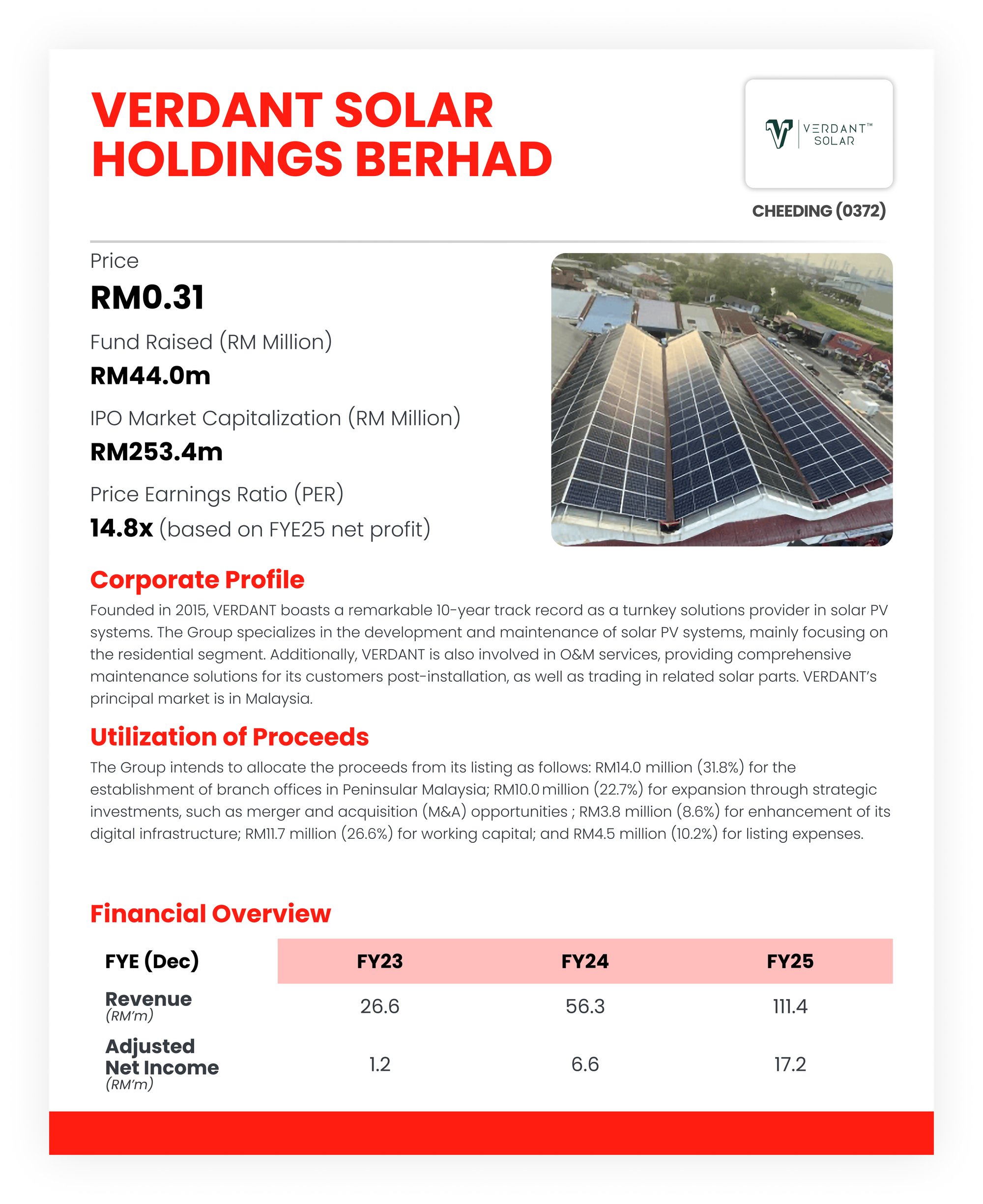

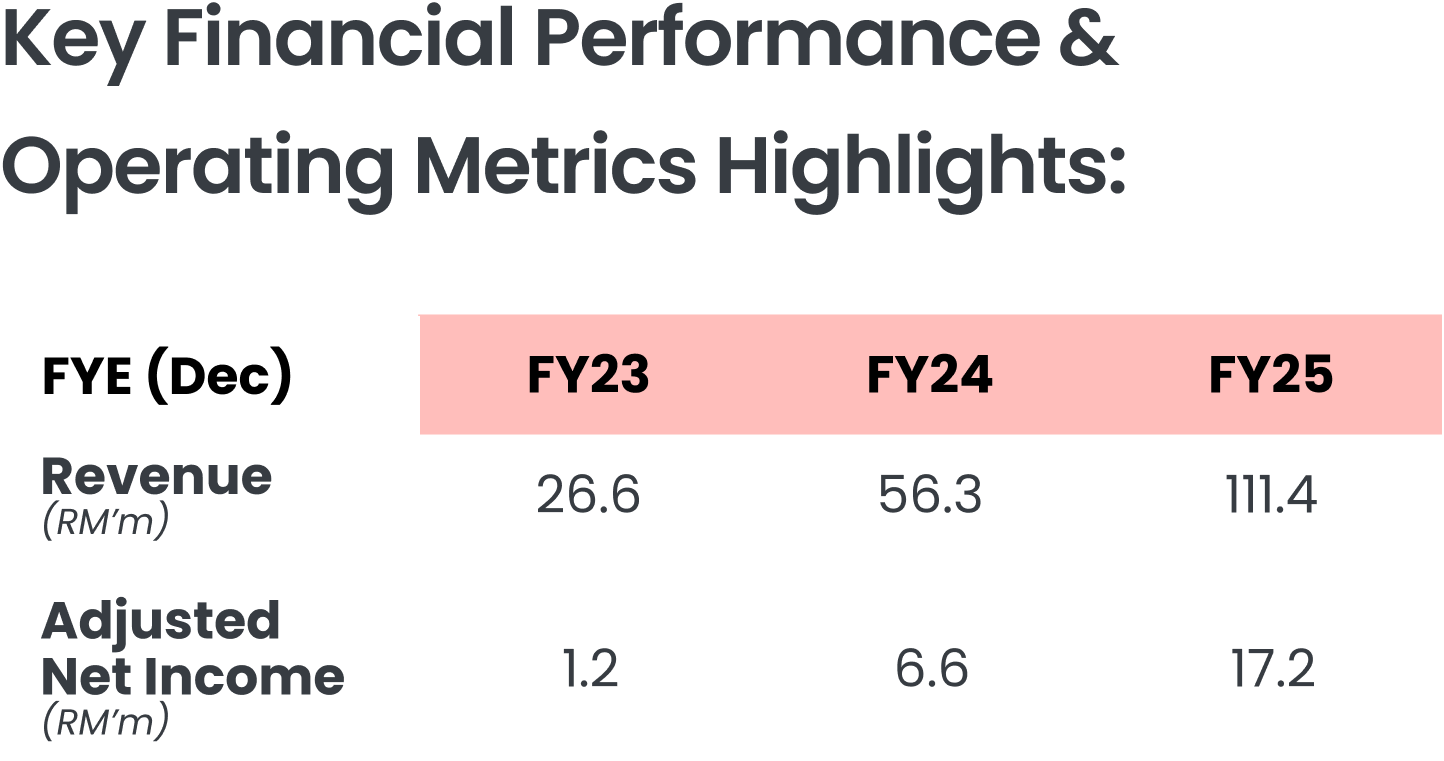

Verdant Solar Holdings Berhad - Upside Potential of 32.3%

Future Plans for Growth:

- Geographic Expansion.

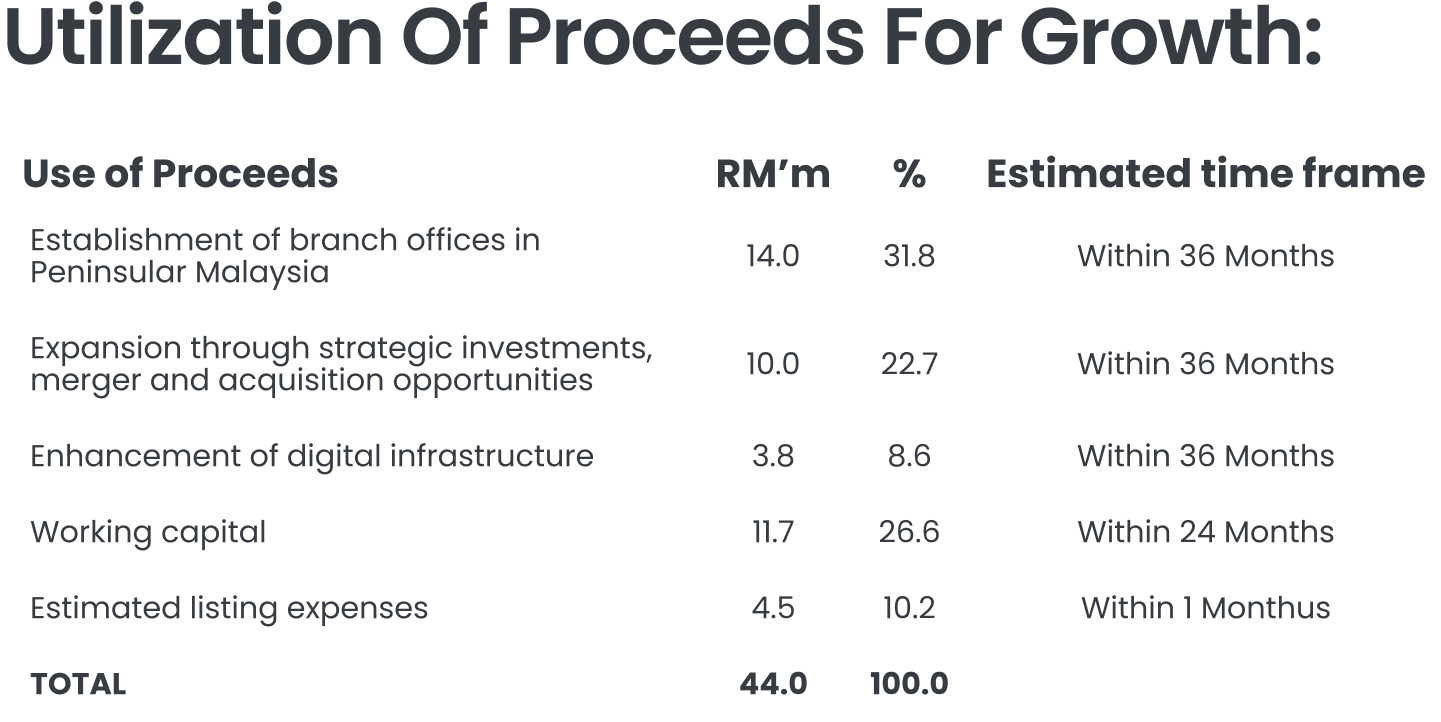

The company plans to strengthen its market presence in Peninsular Malaysia by establishing new branch offices in Melaka, Kuantan, and Ipoh. This expansion will improve response times to customer requests, widen its reach, and capture new opportunities in areas with strong economic and industrial activity. A significant portion of IPO proceeds (RM14 million) is allocated to setting up these offices, hiring 42 new staff, and funding related marketing, operations, and working capital needs.

- Strategic Investments and M&A.

Verdant aims to grow beyond organic expansion by pursuing acquisitions or investments in companies that complement its core solar EPCC services. The focus will be on businesses involved in commercial, industrial, and large-scale solar projects, which typically carry larger contract values compared to residential projects. By acquiring firms with established customer bases, technical expertise, and certifications, Verdant intends to diversify its portfolio, enhance operational efficiency, and expand into higher-value segments.

- Digital Transformation and Efficiency.

The company is investing RM3.8 million in digital infrastructure to enhance efficiency and customer experience. This includes implementing an ERP system to streamline operations, upgrading its “Verdant Home” mobile app for both customers and subcontractors, and deploying a CRM system to improve lead management and customer relationships. These digital upgrades aim to scale the business effectively, improve sales tracking, and deliver better user experiences, positioning Verdant as a tech-enabled solar solutions provider.

M+ Fair Value

We assign a target P/E of 18.0x pegged on mid-FY27f EPS, translating to a fair value of RM0.41 per share. While the selected peers’ average P/E stands at ~22.7x, we believe it is more meaningful to benchmark against the peers’ subsidiaries earnings that are directly comparable to VERDANT’s, given its niche model; in which resulting in a lower multiple of 18x, consistent with the 10-year average P/E of the Bursa Utilities Index.