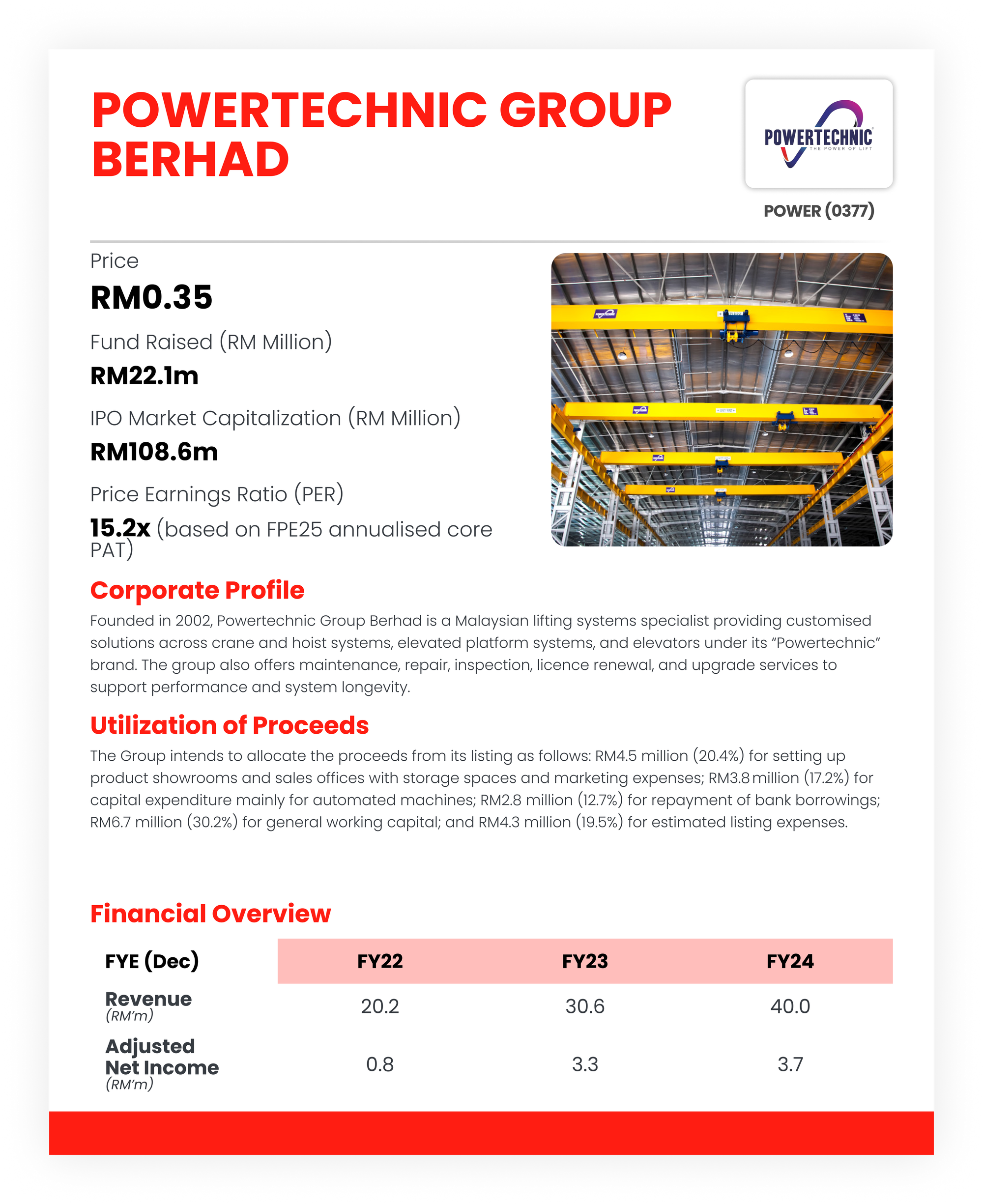

Powertechnic Group Berhad - Upside Potential of 20.0%

Future Plans for Growth:

- Investment in automation to enhance fabrication processes.

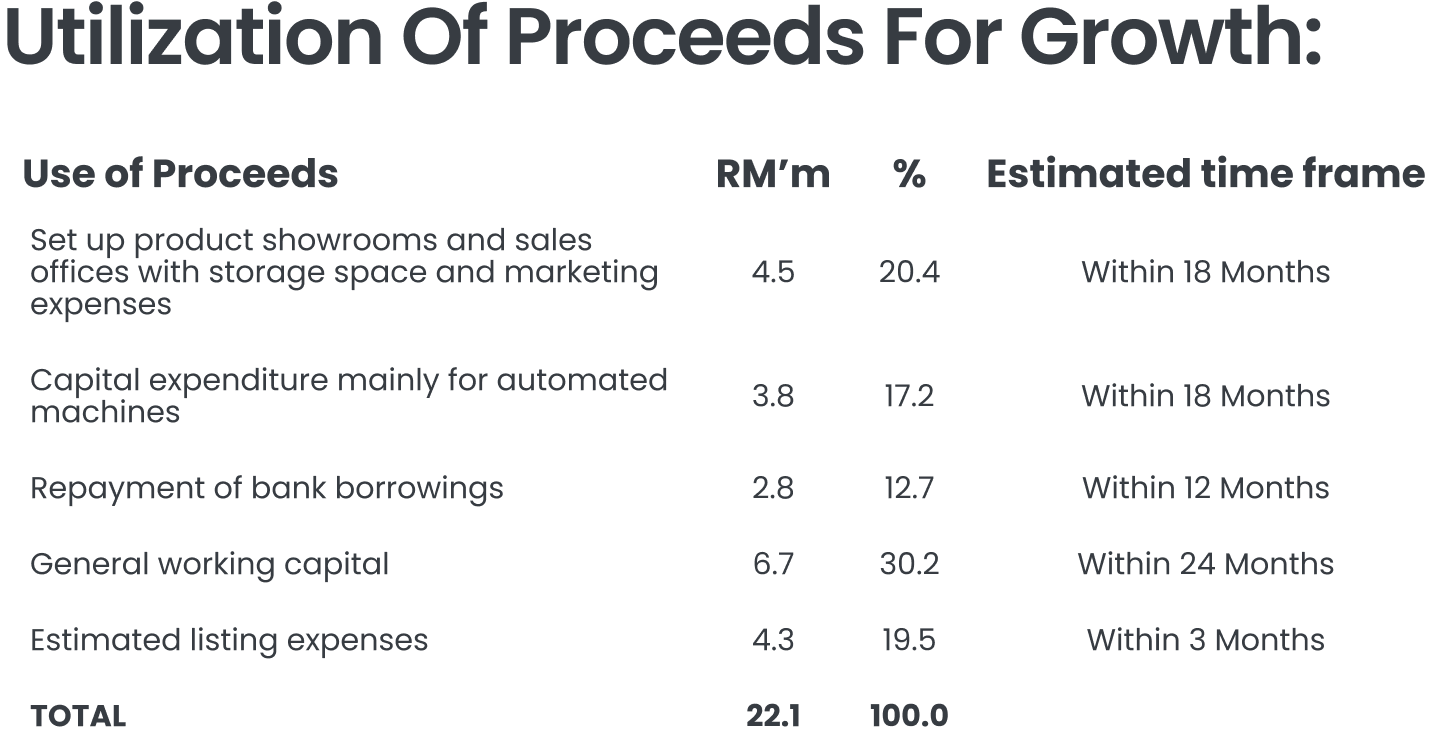

The group plans to allocate RM3.8m (17.2% of IPO proceeds) for the purchase of automated machinery, including robotic welding, laser cutting, bending, and powder coating systems, to improve precision, speed, and scalability of its fabrication processes. In addition, a truck with a crane will be acquired to support material transport between facilities and customer sites, thereby improving operational efficiency.

- Expansion of showrooms and sales offices.

To strengthen its market presence beyond the southern region of Peninsular Malaysia, Powertechnic intends to establish two new product showrooms and sales offices with storage facilities, one in Penang and another in Sarawak. This expansion will enhance customer accessibility and support penetration into the northern and East Malaysia markets..

- Increased brand-building and marketing initiatives.

The group will continue to grow its “Powertechnic” brand through both digital and offline channels. Planned initiatives include targeted digital marketing campaigns, content creation, and participation in trade shows and industry events to drive greater brand visibility and support long-term sales growth.

M+ Fair Value

We assign a fair value of RM0.42 per share for POWER, representing a 20.0% upside from its IPO price of RM0.35. This valuation is based on a P/E ratio of 22.3x, pegged to the FY26F EPS of 1.87 sen.

Given that the Bursa Malaysia’s Industrial Production Index is trading within a trailing P/E valuation band of 22.3x (-1 standard deviation) to 40.1x (+1 standard deviation) based on its 1-year average P/E of 31.2x, we ascribed the P/E multiple to the lower end of the range due to POWER’s small market capitalization of RM108.6m.