PMCK Berhad IPO - Upside Potential of ~40.9% - 54.5%

Future Plans for Growth:

- Expansion of Medical Centre Operations in Kulim, Kedah

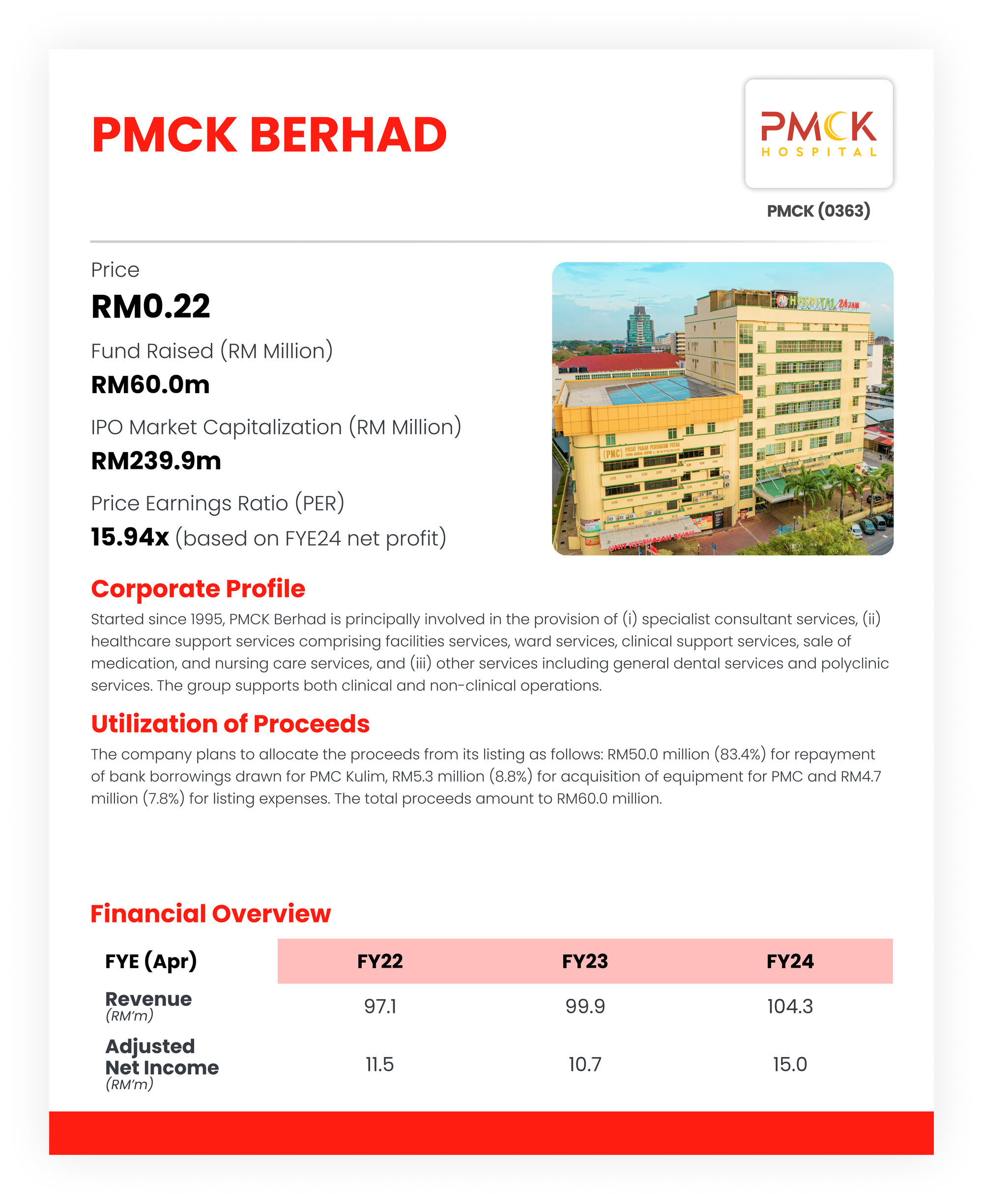

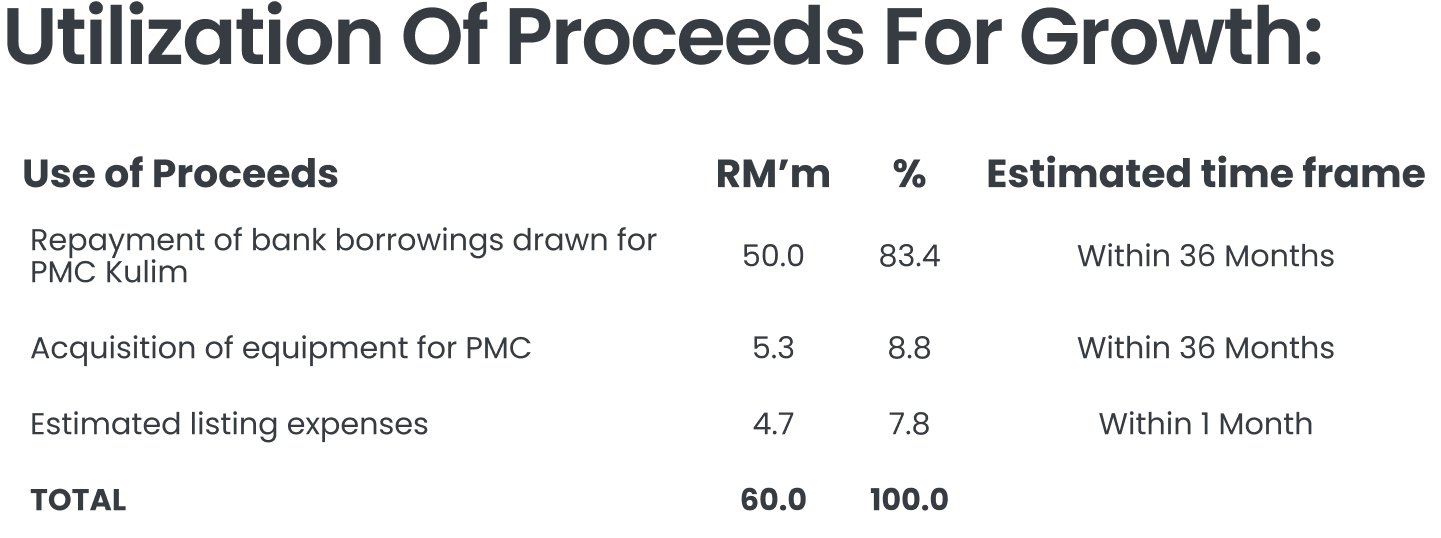

The group plans to establish a new 12-storey private medical centre, PMC Kulim, in Kulim Hi-Tech Park, Kulim Kedah. This new facility will integrate existing operations in the area, namely Poliklinik Unik and Klinik Pergigian Unik, under one roof. The development will also include a 7-storey mixed-use building with a food court and hotel accommodation tailored for patients’ families. New services like IVF will also be offered in PMC Kulim. The total development cost is estimated at RM193.0m, to be funded by RM166.0m in bank borrowings and RM27.0m in internally generated funds. RM50m (83.4% of the IPO proceeds) will be used to repay borrowings drawn for this project. - Expansion and Consolidation of Medical Laboratory Services in Kulim

The group has commenced operations of its first standalone medical laboratory, RYM DX Lab, in Kulim as of March 2025. The lab currently supports in-house testing for Poliklinik Unik and is set to offer services to third-party healthcare providers and the public. Upon the opening of PMC Kulim in Q1 2028, PMCK plans to consolidate RYM DX Lab into the new medical centre. This integration is aimed at streamlining operations, improving turnaround times, and enhancing diagnostic control, thereby elevating the overall patient experience. - Upgrading of Facilities and Solar Panels at PMC Alor Setar

The group plans to upgrade facilities at PMC Alor Setar to enhance diagnostic capabilities and operational efficiency, including a new automated clinical analyser system, mammography unit, and picture archiving and communication system (PACS). These upgrades are targeted for completion within 36 months post-listing, and will be funded through a mix of IPO proceeds (RM3.77m) and internal funds (RM0.06m). Additionally, the group plans to replace its existing underperforming solar panels with higher-efficiency units, boosting power generation capacity from 425kW to 625kW. This initiative will be fully funded by IPO proceeds, with RM1.5m (2.5% of IPO proceeds) allocation.

Fair Value Price Range

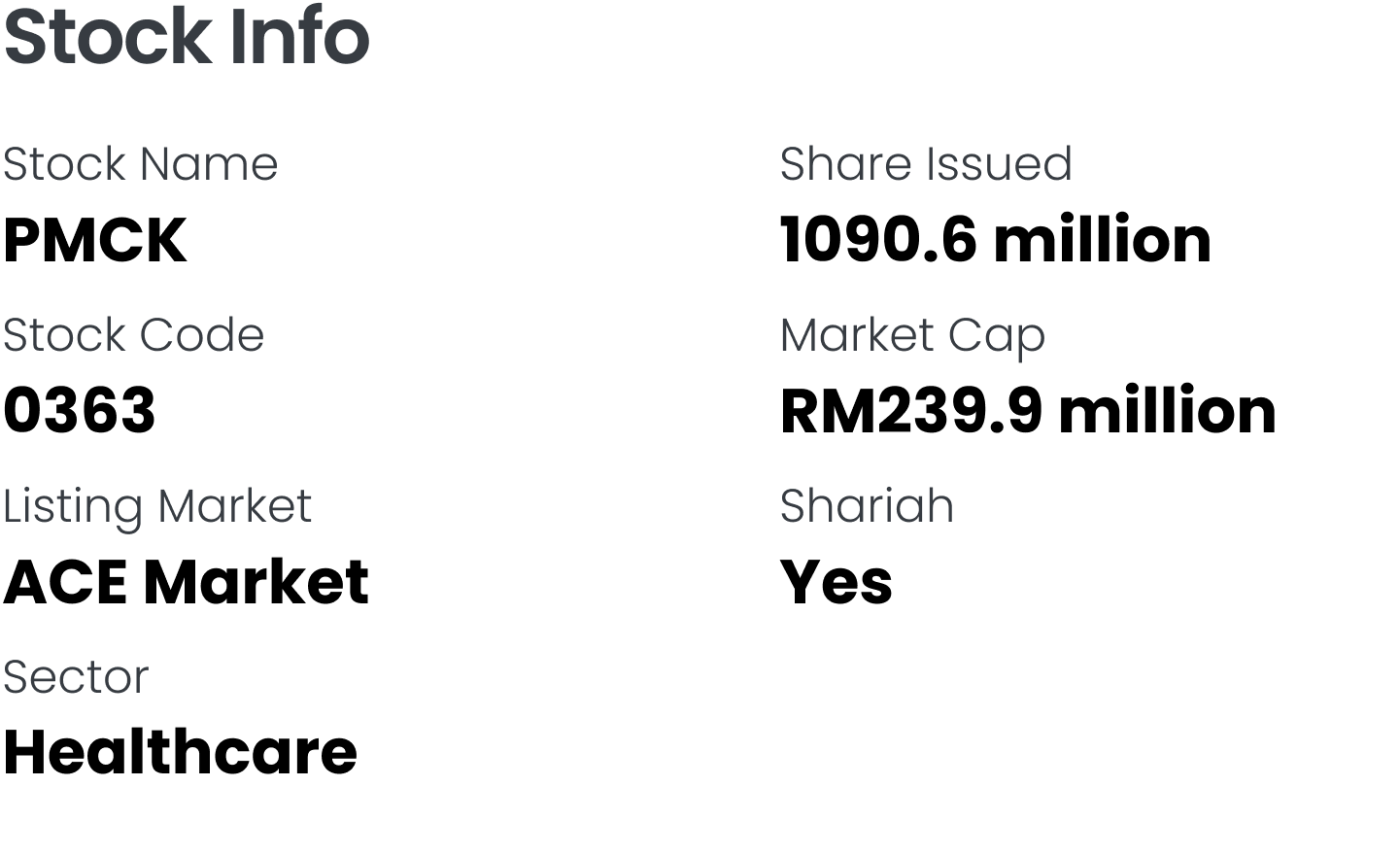

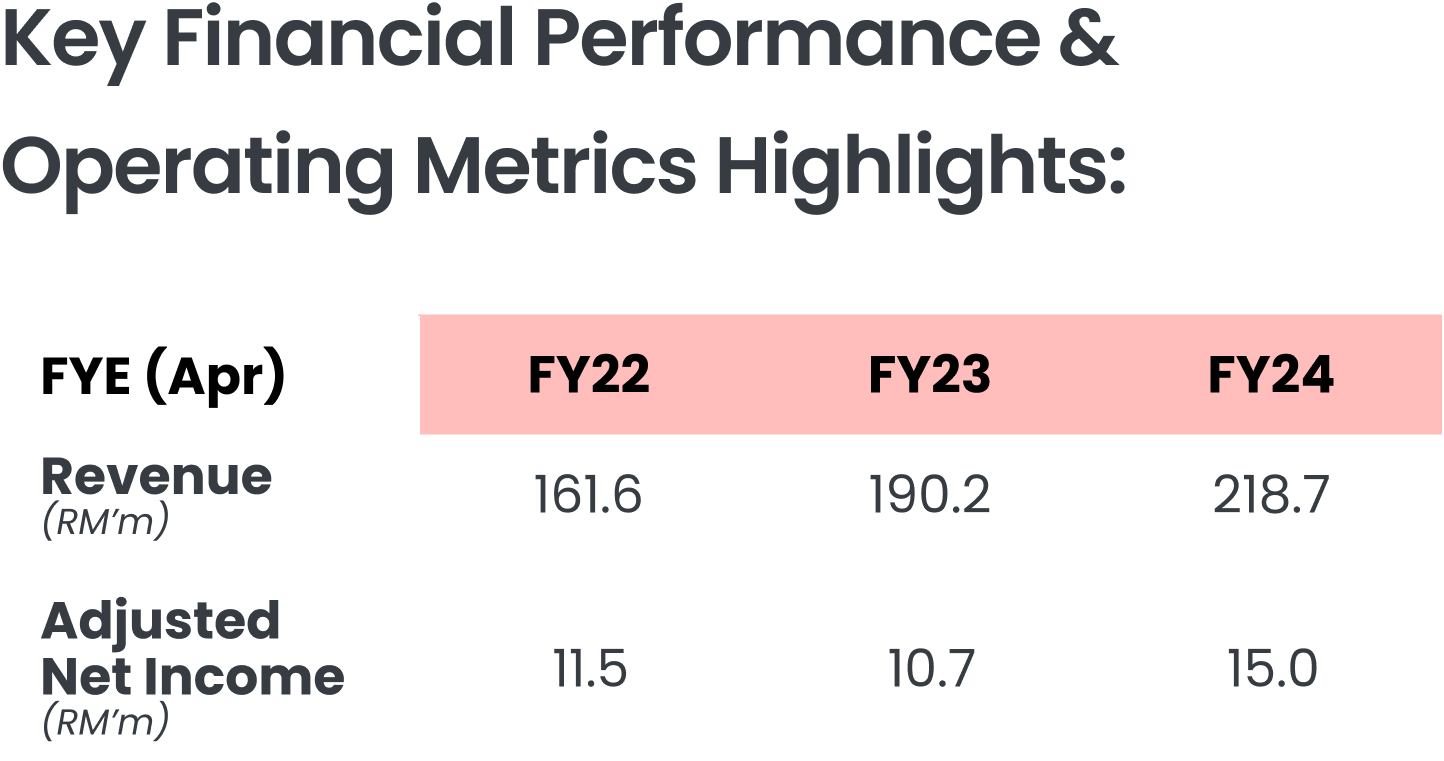

Based on FY22–FY24, the revenue of the group was growing consistently from RM97.1m to RM104.3m, showing a steady 3-year CAGR of 3.7%. A conservative assumption of 2.9% revenue growth for FY25 to FY27 appears reasonable, while waiting for the commencement of PMC Kulim in 1Q 2028.

The average historical P/E and forward P/E of its industry peers are trading between 30.5–34.0x. However, we would give a discount of 30% to the range as PMCK has a lower market capitalisation and is mainly focusing in Kedah, as compared to its peers which have high market capitalisation and established hospitals nationwide.

A 30% discount will result in a range of 21.4–23.8x. Hence, by applying the discounted peer average historical and forward P/E of 21.4-23.8x to mid-FY27F EPS of 1.44 sen, this will yield a fair value of RM0.31 to RM0.34, representing a potential upside of 40.9% to 54.5% from the IPO price of RM0.22.

Investors are advised to take note that actual valuations will always depend on market conditions and the company's ability to sustain earnings growth moving forward.