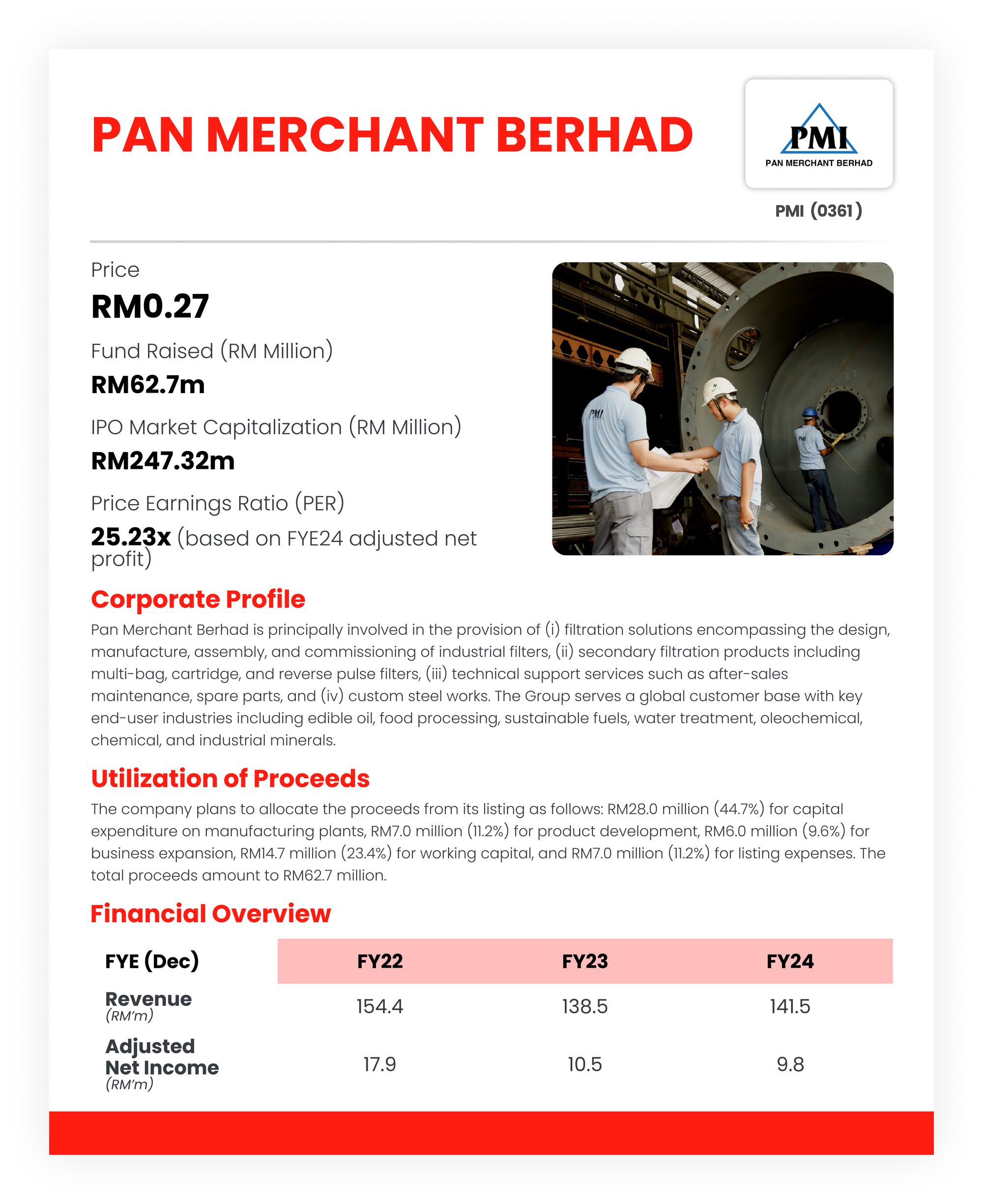

Pan Merchant Berhad - Upside Potential of 22.2%

Future Plans for Growth:

- Enhancement of manufacturing capabilities at existing manufacturing plants.

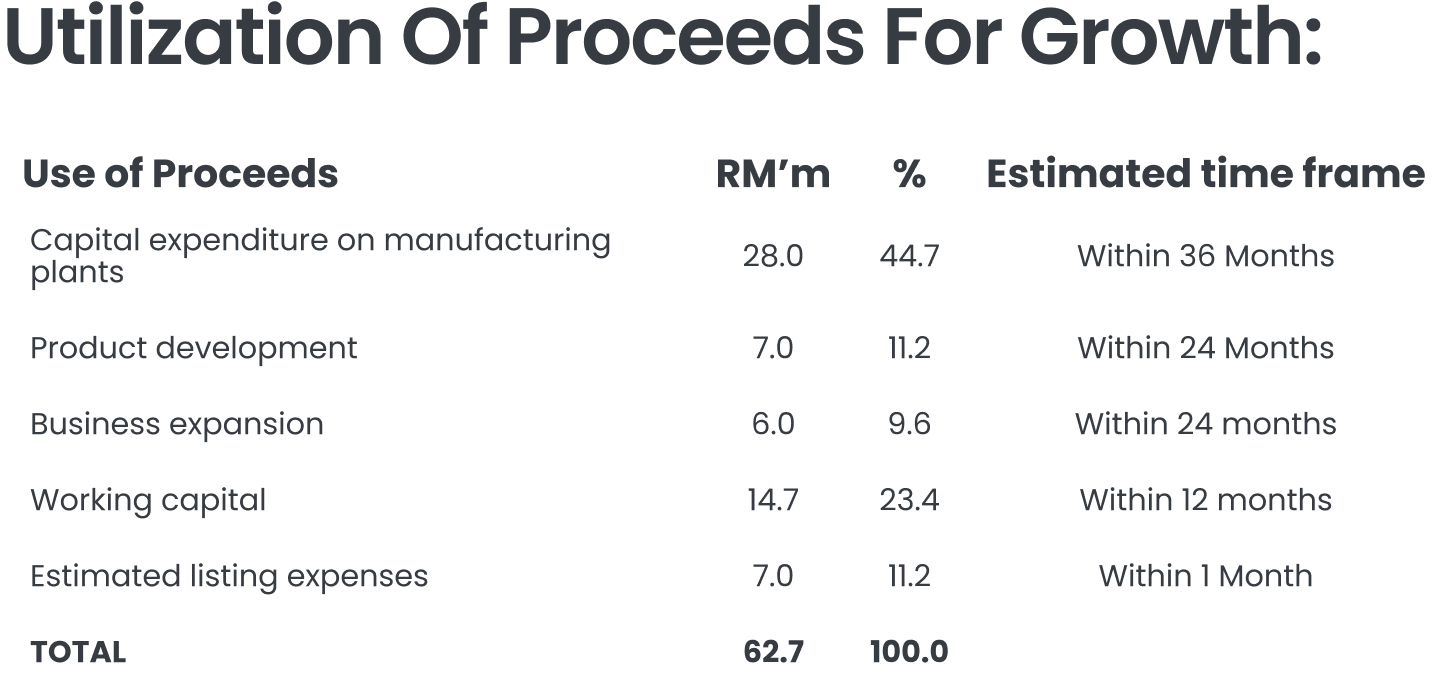

Pan Merchant plans to upgrade its existing Jelapang Plant 1, Jelapang Plant 2, and Lahat Plant by acquiring new machinery and tools to automate key manufacturing processes. This initiative aims to improve production consistency, reduce material wastage, lower labour dependency, and minimise outsourcing, thereby improving profit margins. Additionally, a new filter leaf production line will be set up at Jelapang Plant 1 to support rising demand. Renovation works, including improved plant layout, flooring, and installation of overhead cranes and forklifts, will be carried out in phases to avoid major disruptions. All upgrades are expected to be completed within 36 months post-listing, funded via IPO proceeds of RM28.0m.

- Product development plan to diversify end-user industries.

Pan Merchant plans to invest in product development to customise filters for new industries, with a focus on entering the mining sector. The mining industry, characterised by high-value, large-sized filters and limited competition, presents strong growth potential. A prototype filter tailored for mining applications is targeted for development by end-2026. To support this initiative, the group will also establish a mobile filtration test centre by end-2027 to enhance on-site demonstrations and testing capabilities. Recruitment of industry-specific specialists and engineers, alongside laboratory upgrades at its headquarters, will further strengthen the group’s R&D and design capabilities. These initiatives will be funded through IPO proceeds of RM7.0m and internally generated funds.

- Expansion of European operations and international brand presence.

Pan Merchant intends to strengthen its global footprint by expanding its Netherlands office, which currently serves as its European hub. A new filter leaf assembly line will be established to manufacture replacement parts, enhancing production capacity and reducing lead times and logistics costs across the region. The existing premises will be renovated and expanded to a built-up area of 7,200 sq. ft., including a workshop, office, demonstration room, and reception area. Renovation and setup are expected to complete within 24 months from the receipt of IPO proceeds of RM6.0m. Additionally, the group will intensify international sales and marketing activities, particularly in Europe and America, through increased participation in global exhibitions and refreshed corporate branding materials.

M+ Fair Value

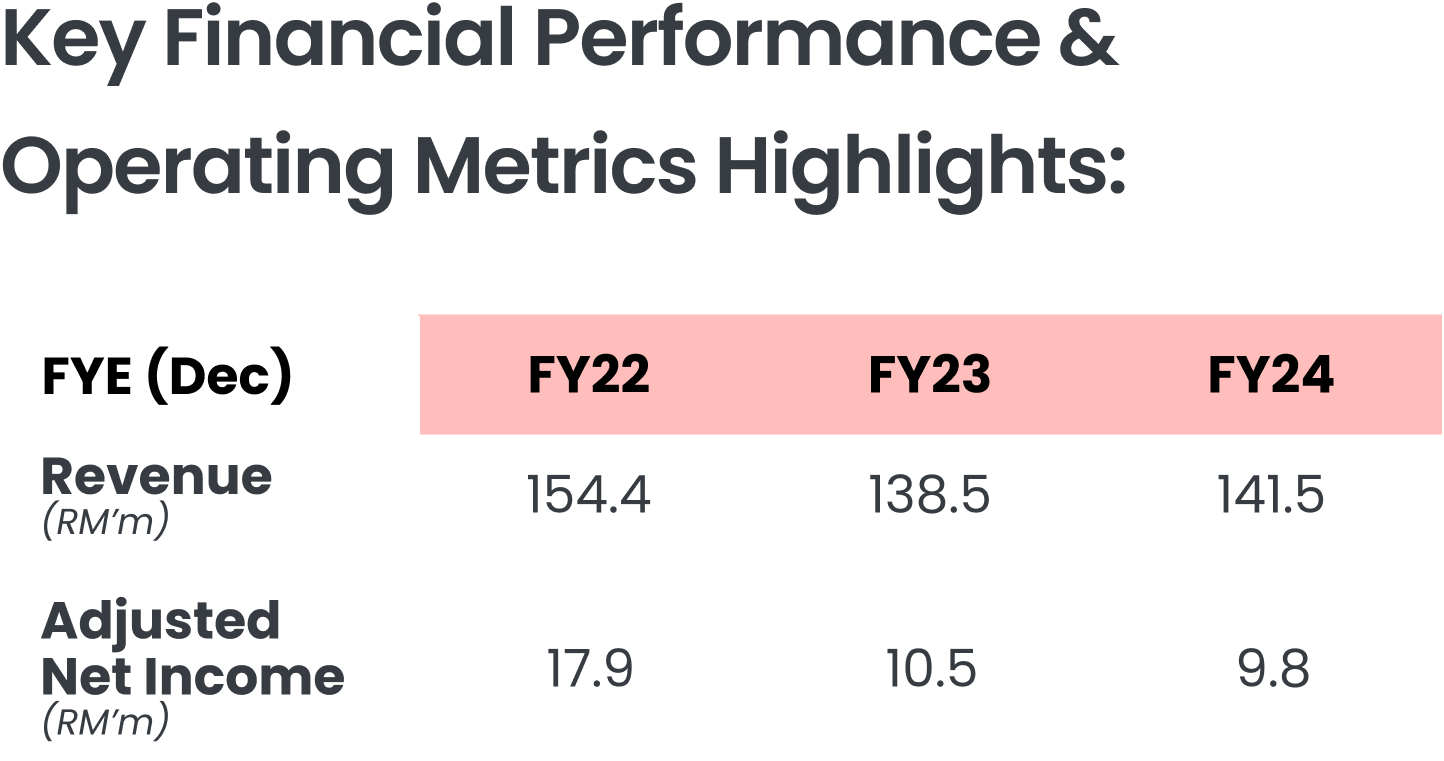

We assign a fair value of RM0.33 per share for PMIBHD, representing a 22.2% upside from its IPO price of RM0.27. This valuation is based on a P/E ratio of 25.0x, pegged to the mid-FY26F EPS of 1.30 sen. We believe the ascribed P/E is fair, given that the Bursa Malaysia Industrial Production Index (KLPRO) has been trading within a trailing P/E valuation band of 23.6x (-1 standard deviation) to 34.8x (+1 standard deviation), based on its 2-year average P/E of 29.2x.

Meanwhile, even though the ascribed P/E multiple is higher than that of its international peers, which trade at an average forward P/E and historical P/E of 15.3x to 17.6x, we believe the higher valuation is justified. Unlike its European counterparts, PMIBHD incurs significantly lower production costs while delivering similar products. This cost advantage should not only support the group’s target global market share of 1%-2% through competitive pricing but also bolster its ongoing global expansion efforts. Also, PMIBHD is Malaysia’s largest solid-liquid filtration provider by revenue, further reinforcing its strong market position.