Oxford Innotech Berhad - Upside Potential of ~20.5-71.3%

Future Plans for Growth:

- Expansion of customer base and product offerings.

OXB aims to grow revenue by diversifying its customer base and products. Following acquisitions in FY2023, it entered the ergonomic furniture, automotive, and modular building sectors. With Malaysia’s expanding E&E industry, OXB plans to offer integrated engineering solutions to local and international clients in EMS, semiconductor testing, and automated fabrication.

- Expansion of production capacity and capabilities.

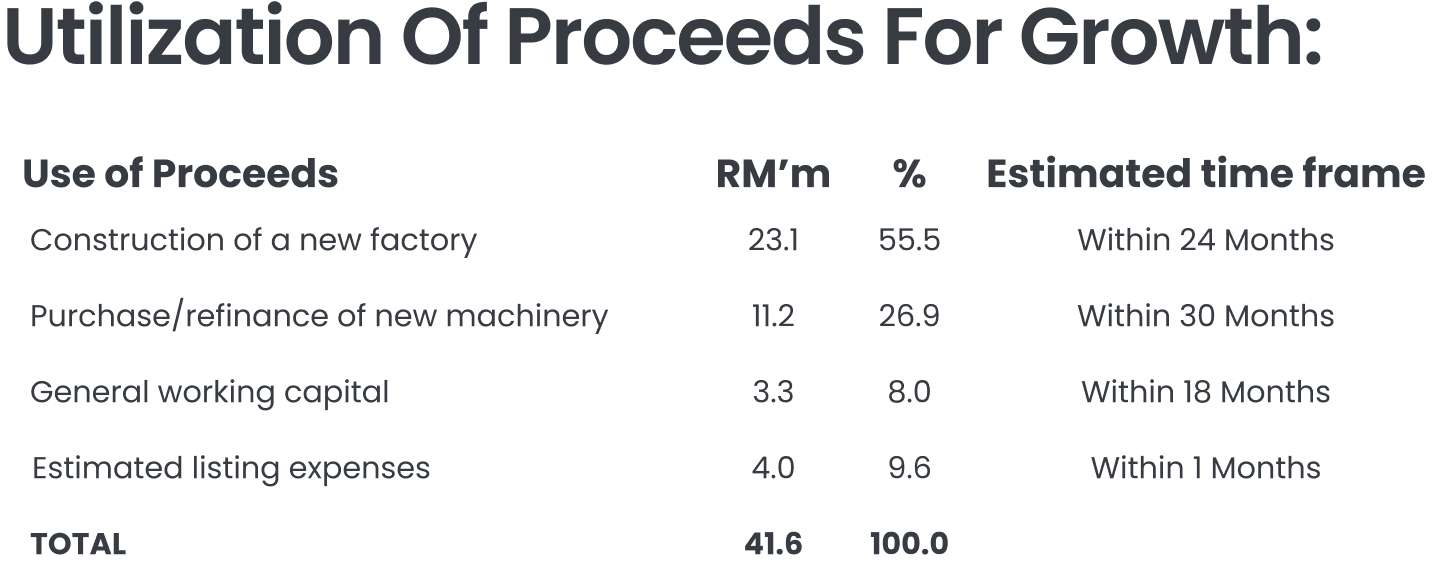

To support growth, OXB plans to build a new facility—Penang Science Park Factory 2—to resolve space constraints and serve modular building clients. The new site will become the company’s headquarters. Additionally, OXB will invest in new machinery to boost production capabilities and meet increasing demand for its integrated engineering solutions.

M+ Fair Value

In FY24, Oxford Innotech registered a 87.6% YoY topline growth to RM92.9 million, driven by strong orders from its specific segments. While the topline grew at an impressive CAGR of 54.6% over the past four years, we estimate a conservative -10%/10%/15% growth rate over the next three years. We believe this is reasonable, as we understand there will be a scaling down of orders from its major customer, SIBS, who are currently transitioning projects and awaiting for finalization. All orders are expected to materialize in FY26.

For peer comparison purposes, we have selected several local peers with market capitalizations ranging from RM138.4-480.0m — including AIMFLEX, CORAZA, SFPTECH, and WENTEL for a more fair benchmarking. Based on the peer median historical and forward P/E of 19-27x, pegging to the blended FY25-26f EPS, it will translate to a fair value price range of RM0.35-0.50, implying upside of 20.5-71.3% to the IPO price of RM0.29.