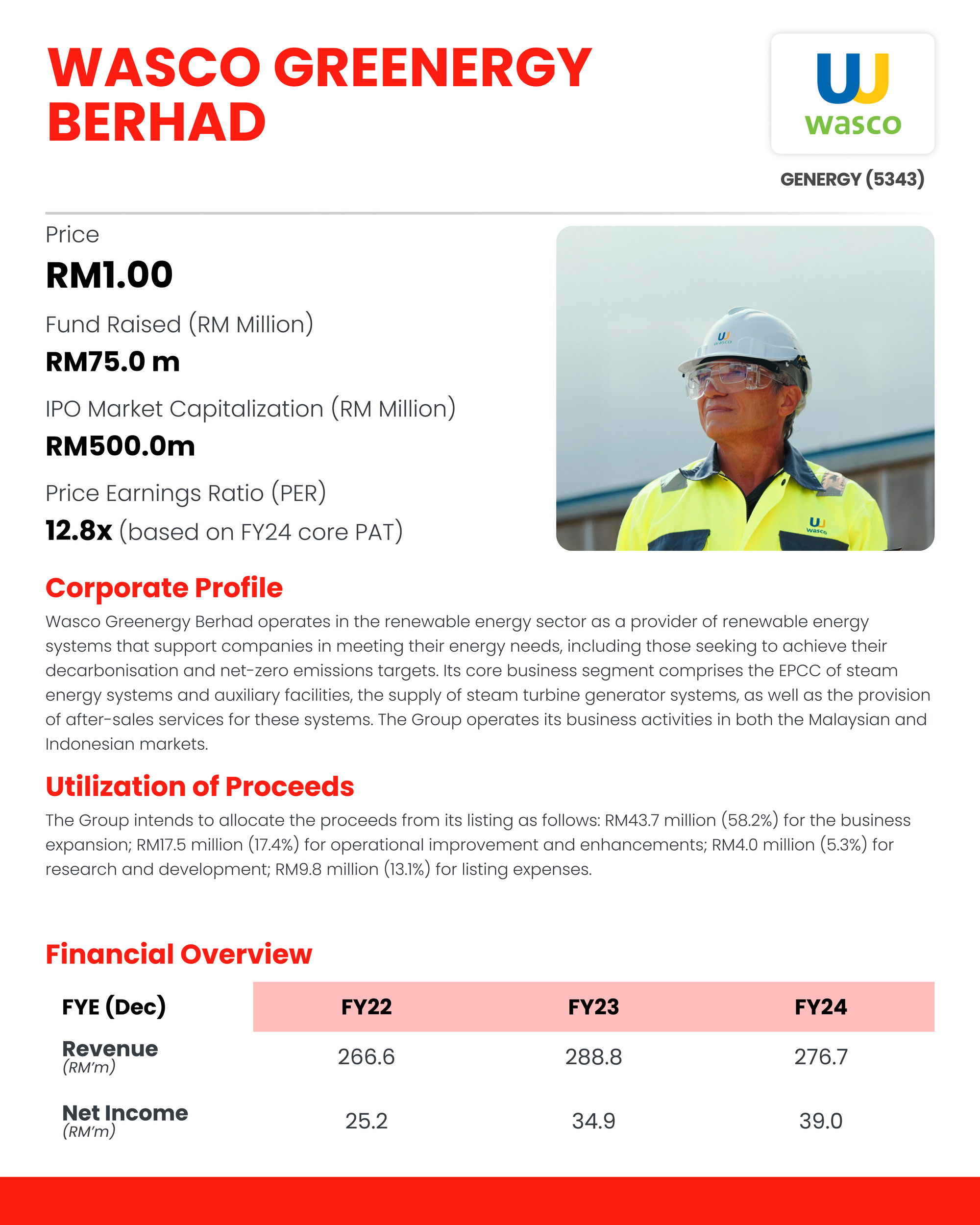

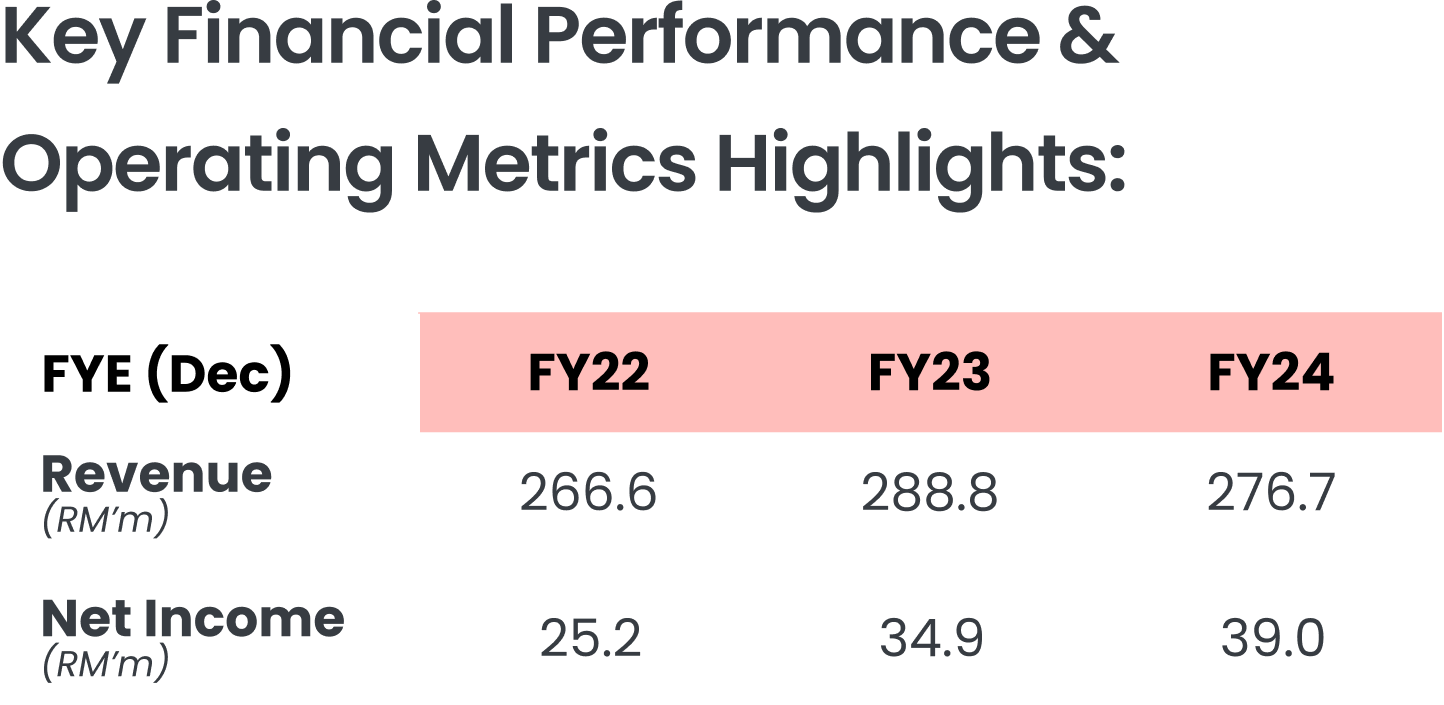

Wasco Greenergy Berhad

Future Plans for Growth:

- Renewable energy business expansion

Wasco Greenergy plans to shift from one-off EPCC contracts to a recurring revenue model by adopting an asset ownership strategy. The Group will own, operate, and maintain biomass steam energy systems and biomass power plants under BOOT/BOO frameworks, supplying steam or power through long-term contracts of 10–20 years. This move strengthens revenue stability, supports industrial customers seeking low-carbon energy, and aligns with the growing biomass market in Malaysia. To reduce risks, the Group will pursue partnerships with biomass suppliers, experienced operators, and industrial users.

- Indonesian business expansion

Wasco Greenergy aims to further expand its presence in Indonesia, which has become its largest overseas market with revenue contribution rising to almost half of the Group’s total. Industry prospects are favourable, with strong projected growth in Indonesia’s biomass boiler and steam turbine markets through 2029. To capture these opportunities, the Group plans to establish a new sales office in Jakarta together with two new service centres in Pekanbaru and Sulawesi. A local presence will allow the company to engage customers more effectively, understand market conditions and regulatory requirements, and deliver faster after-sales support, which is essential for maintaining biomass boilers and steam turbines. The expansion will involve leasing and renovating new premises, purchasing equipment, hiring local sales, technical and support staff, and adding service and logistics vehicles.

- Develop digital infrastructure by incorporating AI-driven analytics

Wasco Greenergy plans to enhance its operations by integrating AI-driven analytics and upgrading digital systems. This includes a project execution and inventory management system for real-time monitoring, an after-sales management system to improve customer service, and an upgraded ERP system to unify core business functions. A strong cybersecurity system will protect data and support secure digital operations. These initiatives are expected to improve efficiency, decision-making, and coordination across the Group will allocate RM5.0m from IPO proceeds over 36 months after listing.