Orkim Berhad - Upside Potential of 26.6%

Future Plans for Growth:

- Fleet Expansion and Rejuvenation

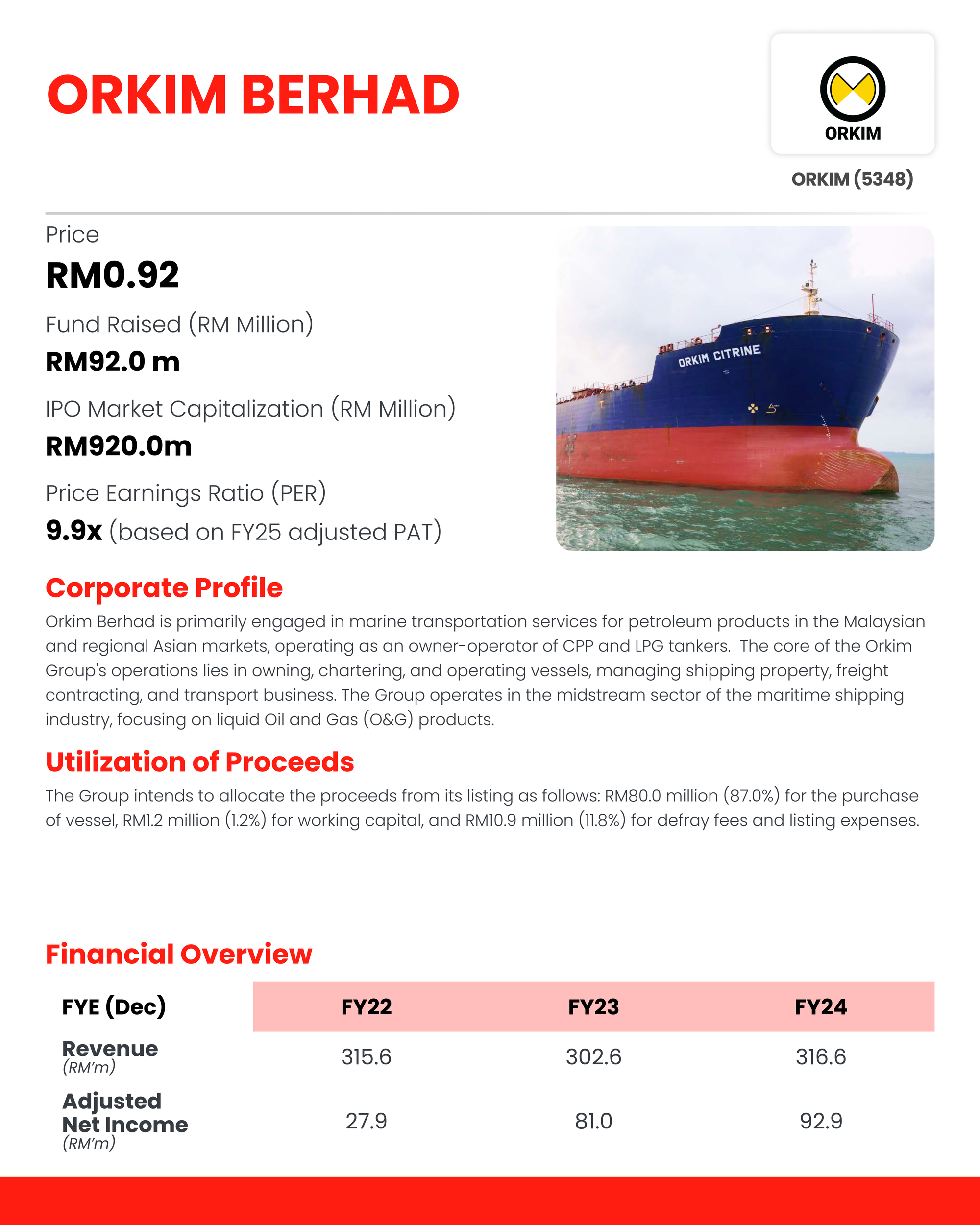

The Group is executing a robust fleet expansion and rejuvenation strategy by investing in younger, larger, and more versatile tankers, focusing heavily on chemical/petroleum product (CPP) carriers. The plan includes the immediate acquisition of the second-hand MR tanker, Orkim Citrine, by October 2025, to serve a PETCO contract, alongside two newbuild CPP tankers, Orkim Ruby and Orkim Judy, scheduled for completion in 2027 with a total construction cost of RM202.6m. Additionally, Orkim Berhad plans to acquire two more chemical/petroleum product tankers within 24 months, with an estimated cost of RM160.0m (RM80.0m will be funded from the IPO proceeds). This strategic shift towards IMO Type II tankers, which can safely transport a wide range of liquid chemicals, petrochemicals, and oleo-chemicals, is designed to capture growth in adjacent market segments. By leveraging their existing expertise in CPP and LPG transport, this initiative will enhance their capacity, achieve greater economies of scale, and strategically position the Group for sustainable expansion within the Malaysian coastal and regional marine transportation market.

- Fleet Modernisation Programme

A significant focus is placed on a fleet modernization program to align with evolving ESG standards and enhance operational efficiency. This plan involves Orkim Berhad setting aside at least RM50m, which will be funded through a combination of internally generated funds and borrowings, within 24 months from listing for extensive upgrades during mandatory dry dockings. Key initiatives include propulsion system enhancements such as installing energy-saving devices like Propeller Boss Cap Fins (PBCF) and engine overhauls to reduce fuel consumption and emissions. Furthermore, The Group will retrofit existing vessels with essential environmental compliance systems like ballast water treatment systems, improved sewage treatment plants, and shaft power limiters. These efforts not only ensure strict compliance with IMO regulations, including the MSO and IBC Code requirements necessary for carrying chemical cargoes, but also prolong the lifespan, preserve the asset value, and enhance the long-term performance and sustainability of the entire fleet.

- Technological Advancements Through Digitalisation

The Group plans to involve technological advancement through digitalization to complement the fleet modernization, focusing on improving vessel performance, fuel efficiency, and reducing operational costs. Orkim Berhad plans to invest an estimated RM1.0m within 36 months to upgrade its digital facilities, of which the amount will be funded through internally generated funds. This includes enhancing the control centre with advanced visualization tools and AI-powered analytics to track real-time vessel performance, identify deviations from optimal operation, and reduce fuel consumption. The Group will utilize a suite of digital technologies to automate and enhance operations, featuring route optimization that uses real-time data factoring in weather and sea currents for fuel-efficient journeys. Furthermore, the plan incorporates predictive maintenance for early issue detection, optimized crew management, and automated regulatory compliance and reporting, all fortified with embedded cybersecurity measures to safeguard operational data.

M+ Fair Value

We assign a fair value of RM1.16 per share for ORKIM, representing a 26.6% upside from its IPO price of RM0.92. This valuation is based on a P/E ratio of 12.0x, pegged to the FY26F EPS of 9.70 sen. We believe the assigned P/E multiple is fair, given that the peer average historical and forward P/E multiples are trading between 10.6x and 15.9x.