Oasis Home Holding Berhad - Upside of 50%

Future Plans for Growth:

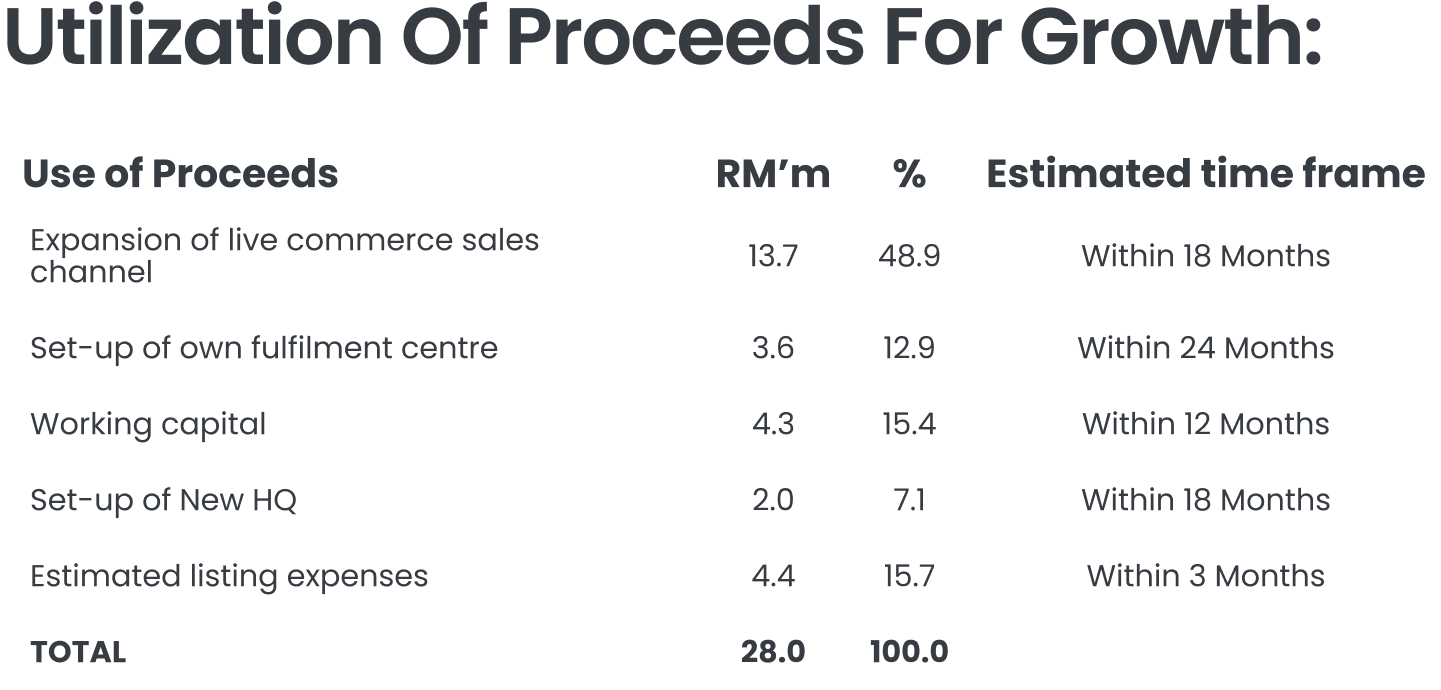

- Expansion of live commerce sales channel.

The group plans to expand its live commerce footprint by launching at least 5 new live commerce channels on Facebook and TikTok. These new channels will focus on high-demand product categories such as wellness, fashion accessories, and travel essentials. To support this, the group aims to hire up to 53 additional personnel and allocate dedicated live streaming rooms at its upcoming HQ.

- Setting up a new HQ.

Oasis Home is planning to develop a 3-storey detached industrial building in Puchong, Selangor, to serve as its New HQ. Spanning 25,956 sq. ft., the facility will include 10–12 live streaming rooms to facilitate the group’s growing live commerce activities.

- Establishment of in-house fulfilment centre.

The group has acquired a 2-storey property with a 14,364 sq. ft. built-up area in the NCT Smart Industrial Park, Selangor, to setup its own fulfilment centre. The facility will support internal logistics, inventory management, and reduce reliance on third-party fulfilment providers. Renovation, fit-out works, and warehouse system upgrades will be funded through IPO proceeds.

M+ Fair Value

We assign a fair value of RM0.42 per share for OHM, representing a 50.0% upside from its IPO price of RM0.28. This valuation is based on a P/E ratio of 18.0x, pegged to the mid-FY26F EPS of 2.35 sen. While this valuation carries a 7.1-20% premium over the Bursa Malaysia Consumer Products Index—which is trading at an average P/E of 16.8x and a forward P/E of 15.0x—we believe the premium is justified as OHM offers a unique exposure to the live commerce segment, a model that is highly adaptable to changing market conditions.