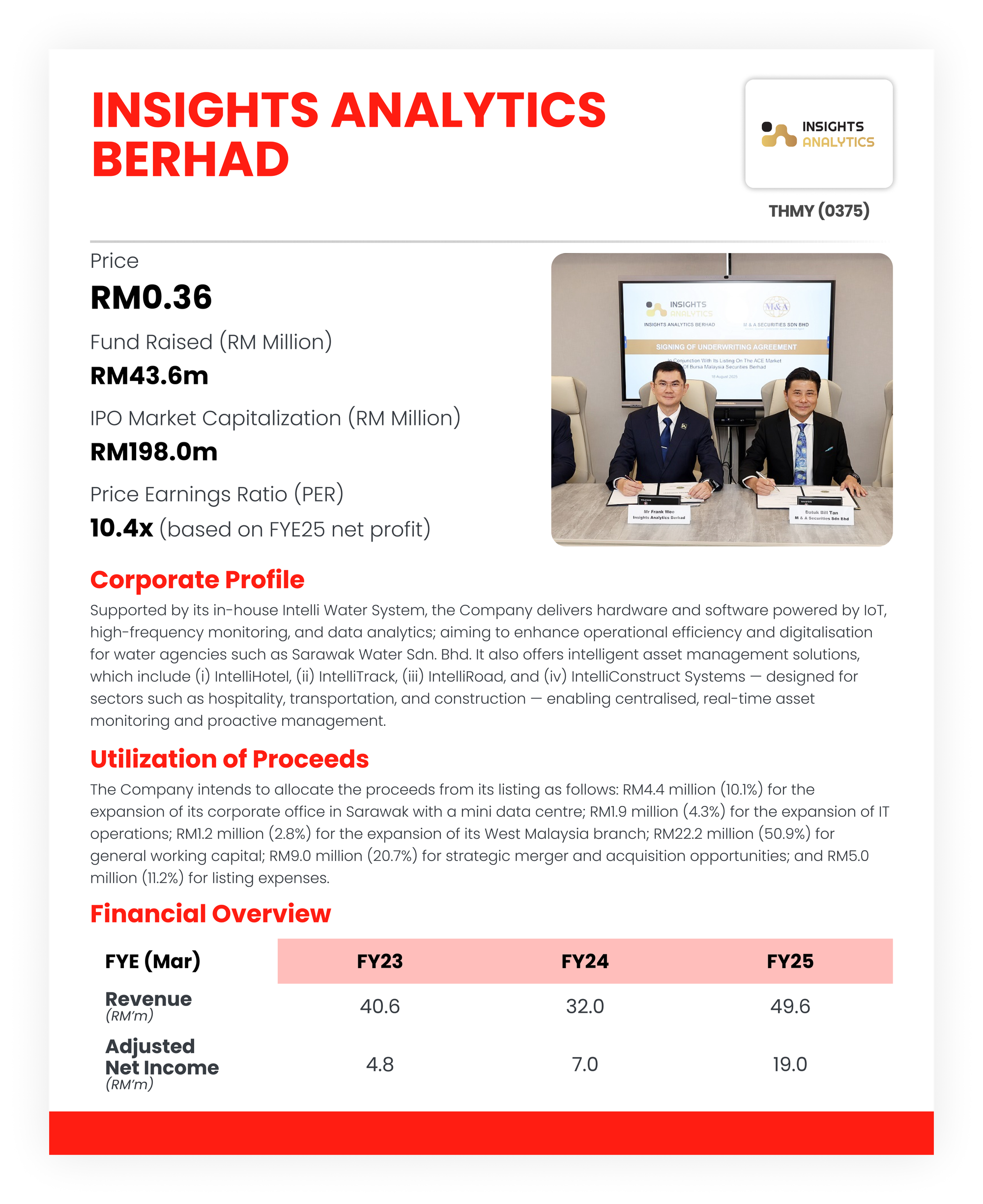

Insight Analytics Berhad - Transforming Water into Value (Upside Potential of 88.0%)

Future Plans for Growth:

- Expansion of IT Capabilities

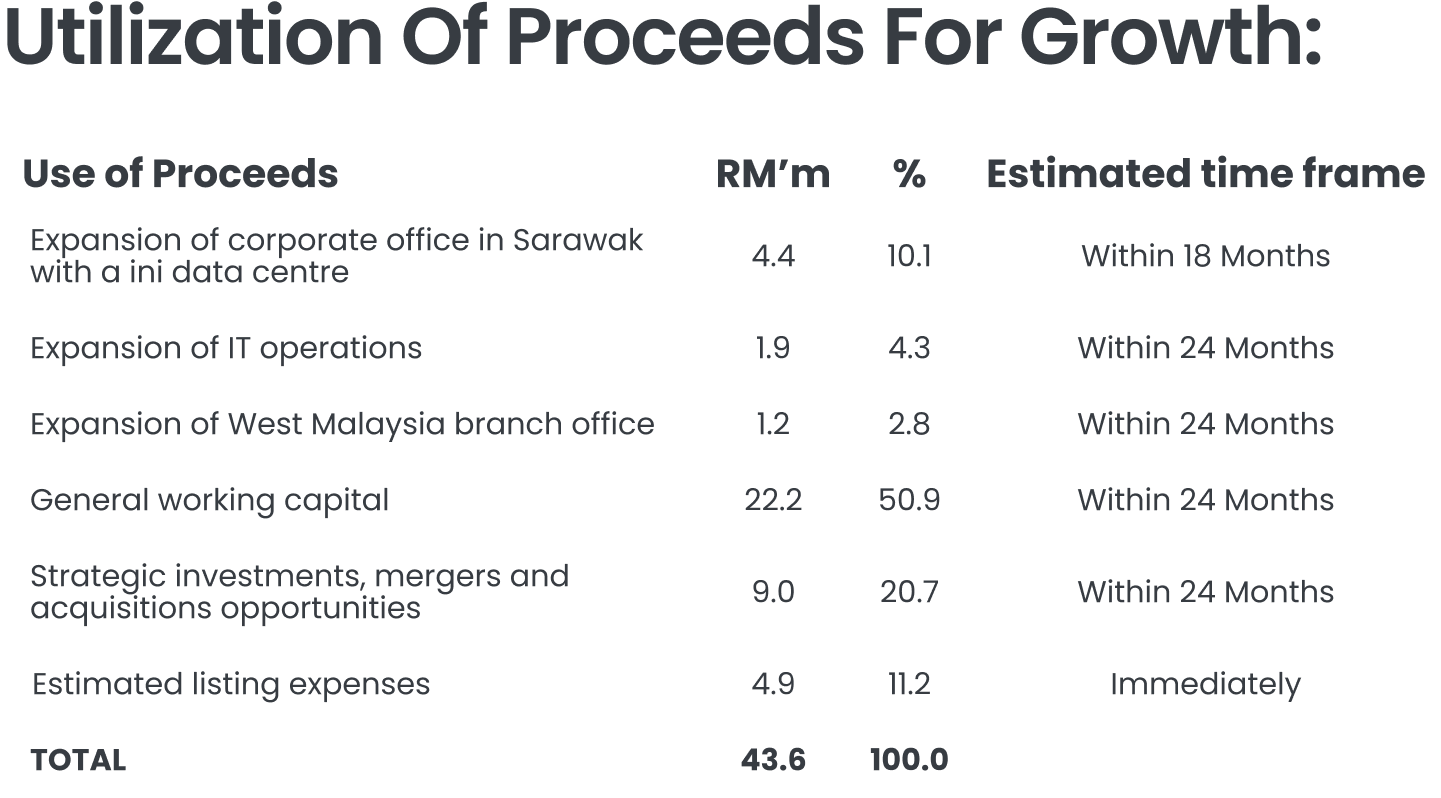

The Company plans to enhance its in-house IT resources to support R&D and strengthen its intelligent asset management solutions segment. This includes recruiting additional IT personnel and establishing a mini data centre to upgrade existing IT and networking infrastructure, improving system efficiency and digital capabilities.

- Growth in the Water Management industry

The Company aims to increase its market share in the water management sector by tendering for projects from Sarawak water agencies. As at LPD, four tenders with a potential value of RM27.8 million have been submitted, positioning the Company to benefit from rising demand driven by government initiatives.

- West Malaysia Market Presence

To expand operations in West Malaysia, the Company will establish a new support team at its branch office, providing permanent staff to facilitate regional business development and capture additional project opportunities.

- Corporate Office Relocation

In anticipation of business growth, the Company plans to relocate to a larger corporate office in Sarawak. The new facility will provide a larger workspace to accommodate the expanded workforce and include upgraded IT facilities, including the mini data centre.

- Strategic Business Expansion

The Company seeks to pursue growth through strategic investments, mergers, and acquisitions to enhance offerings, integrate the value chain, and enable entry into new industry verticals.

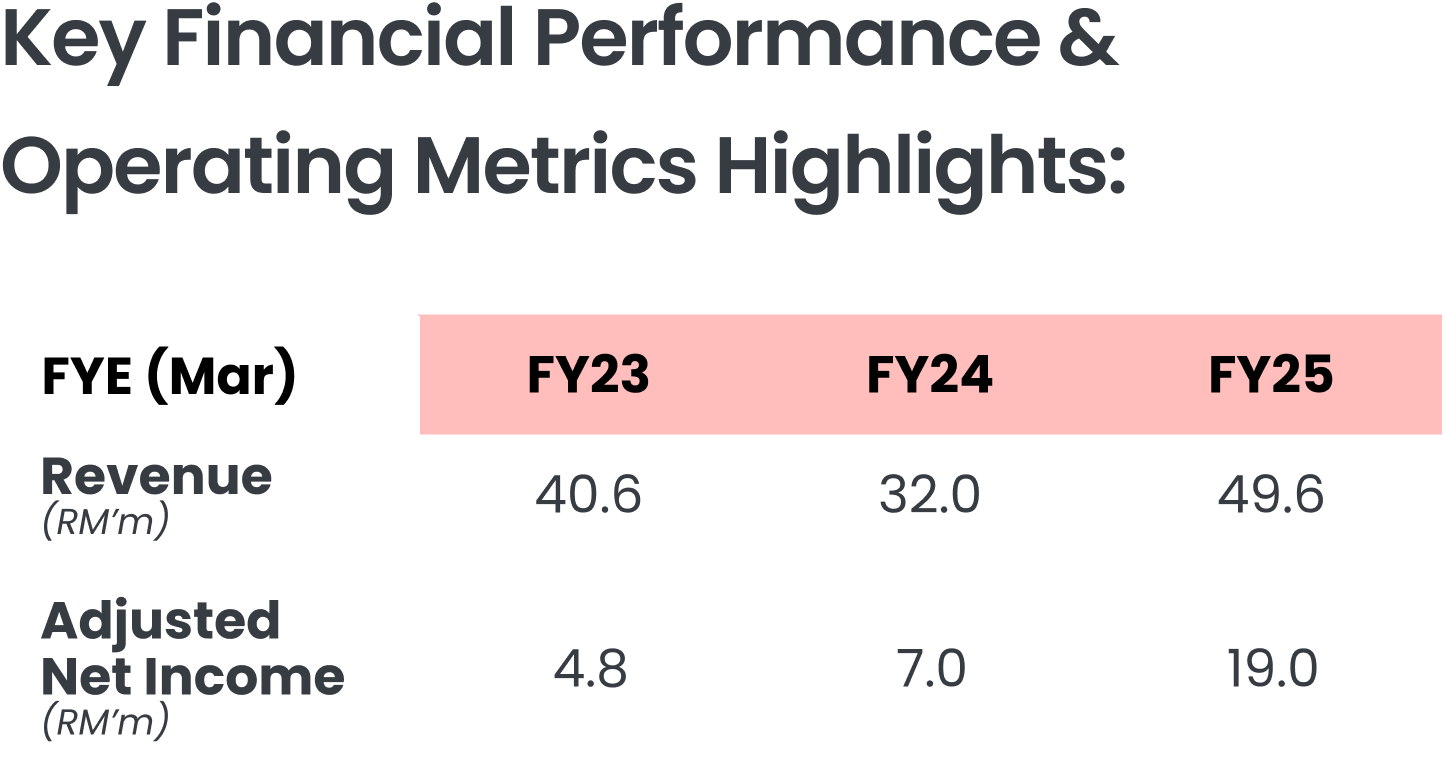

M+ Fair Value

We assign a target P/E of 13.0x, pegged to mid-FY27f EPS, translating to a fair value of RM0.68 per share. While the selected peers’ average P/E stands at approximately 36.6x, we deem our valuation reasonable, given that the Bloomberg GICS Water Utilities segment forward P/E stands at 11x, while the nearest peer is trading at 15x.

However, we do not rule out any potential re-rating catalysts moving forward, given its notably (i) healthy net profit margins, (ii) strong return on equity, (iii) business model that, in our view, provides greater cross-selling opportunities with customers, (iv) potential M&A activities, and (v) leverage on its active R&D efforts, which could enable IAB to tap into broader sectors.