ICT Zone Asia Berhad IPO - Upside Potential of ~10%-75%

Future Plans for Growth:

- Expansion of Technology Financing Solutions Business

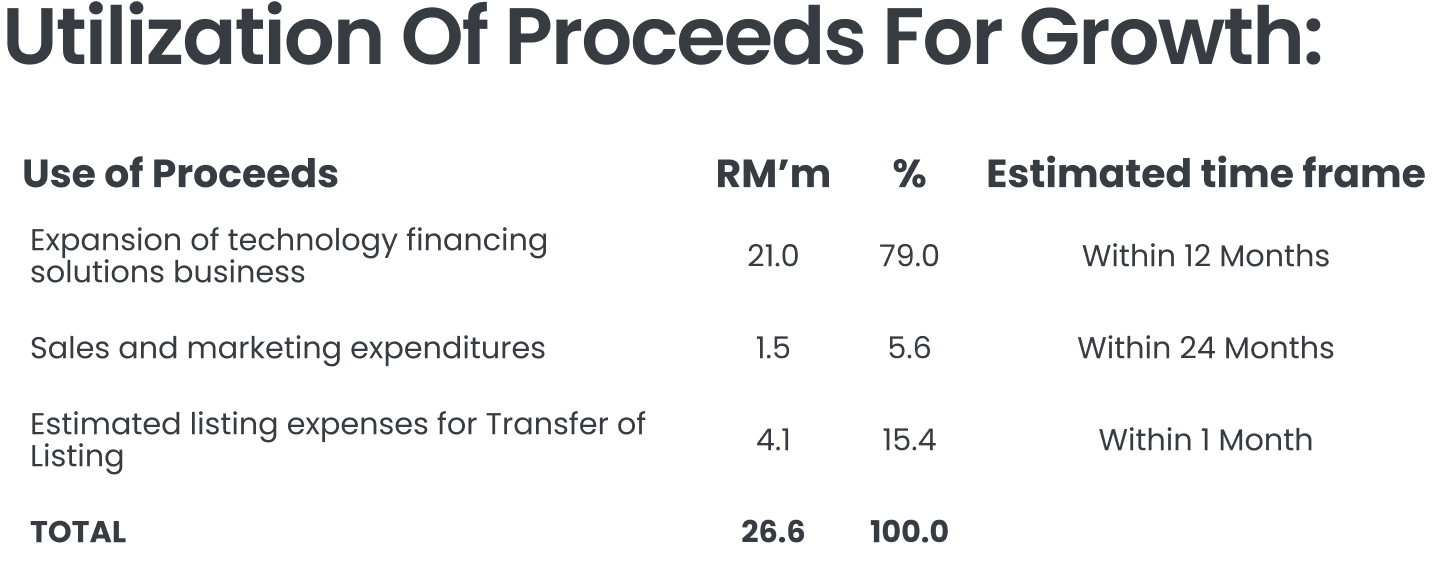

The group plans to expand its technology financing solutions business by allocating RM21.0m (79.0% of IPO proceeds) toward the purchase of ICT hardware and software. ICT hardware includes approximately 4,000 units of computers and laptops bundled with related peripherals like mice, keyboards, monitors and security locks, while software includes operating systems, device management, and computer security software. These ICT Solutions will be deployed under leasing and rental arrangements, enabling clients to access complete, managed technology packages tailored to their operational needs.. - Sales and Marketing Expansion

The group has earmarked RM1.5m (5.64% of IPO proceeds) for sales and marketing initiatives. This includes the recruitment of up to seven new sales and marketing personnel across various seniority levels, with associated staff costs covering salaries, benefits, training, and development over an 18-month period. The group will also invest in a range of marketing activities, including digital campaigns on platforms such as LinkedIn, Instagram, and TikTok, as well as search engine marketing via Google and Bing. Other initiatives include media advertising, telemarketing, email marketing, event promotions, and content creation..

Fair Value Price Range

Based on FY22-FY25, the adjusted PAT of the group was growing consistently from RM4.3m to RM10.6m, showing an impressive 3-year CAGR of 35.1%. Given its strong pipelines secured and post-IPO expansion, a conservative assumption of 15% growth for FY26 and FY27 appears reasonable, with PAT ranging along RM12.2m-RM14.0m.

The average historical P/E and forward P/E of its industry peers are trading between 13.2-21.0x. Hence, by applying the forward peer average P/E of 13.2x to mid-FY27F EPS of 1.65 sen yields a fair value of RM0.22, representing a potential upside of 10% from the IPO price of RM0.20. However, this is based on limited peer coverage and may not fully reflect ICT Zone’s earnings potential.

Meanwhile, by using the historical peer average P/E of 21.0x implies a fair value of RM0.35, translating to an upside potential of 75% from its IPO price of RM0.20. This suggests room for re-rating as ICT Zone's earnings visibility improves.

Thus, we arrive at a fair value range of RM0.22-0.35. Nonetheless, actual valuations will always depend on market conditions and the company's ability to sustain earnings growth moving forward.