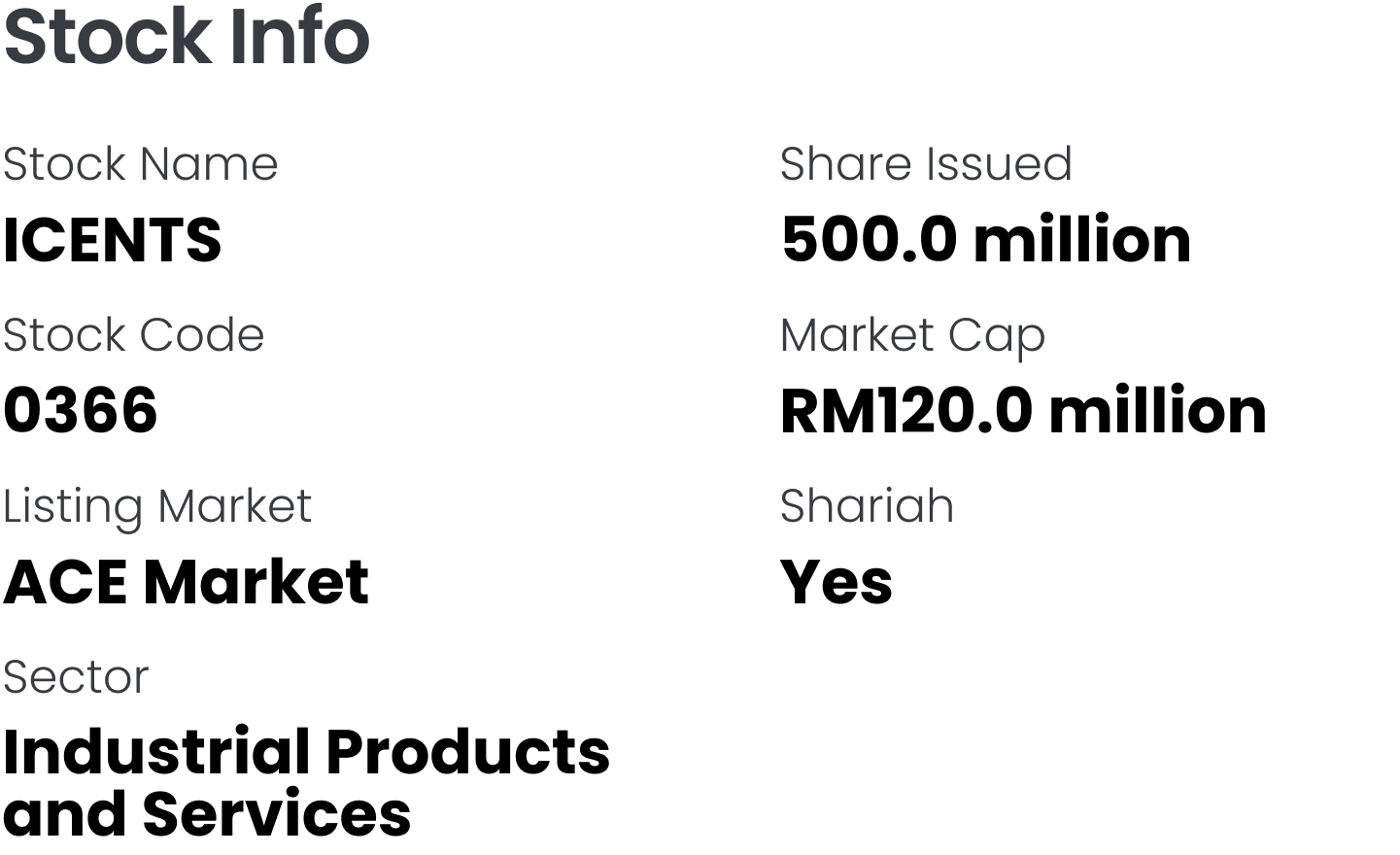

iCents Group Holdings Berhad - Upside Potential of 25.0%

Future Plans for Growth:

- Enhance operational capabilities and recruit engineers.

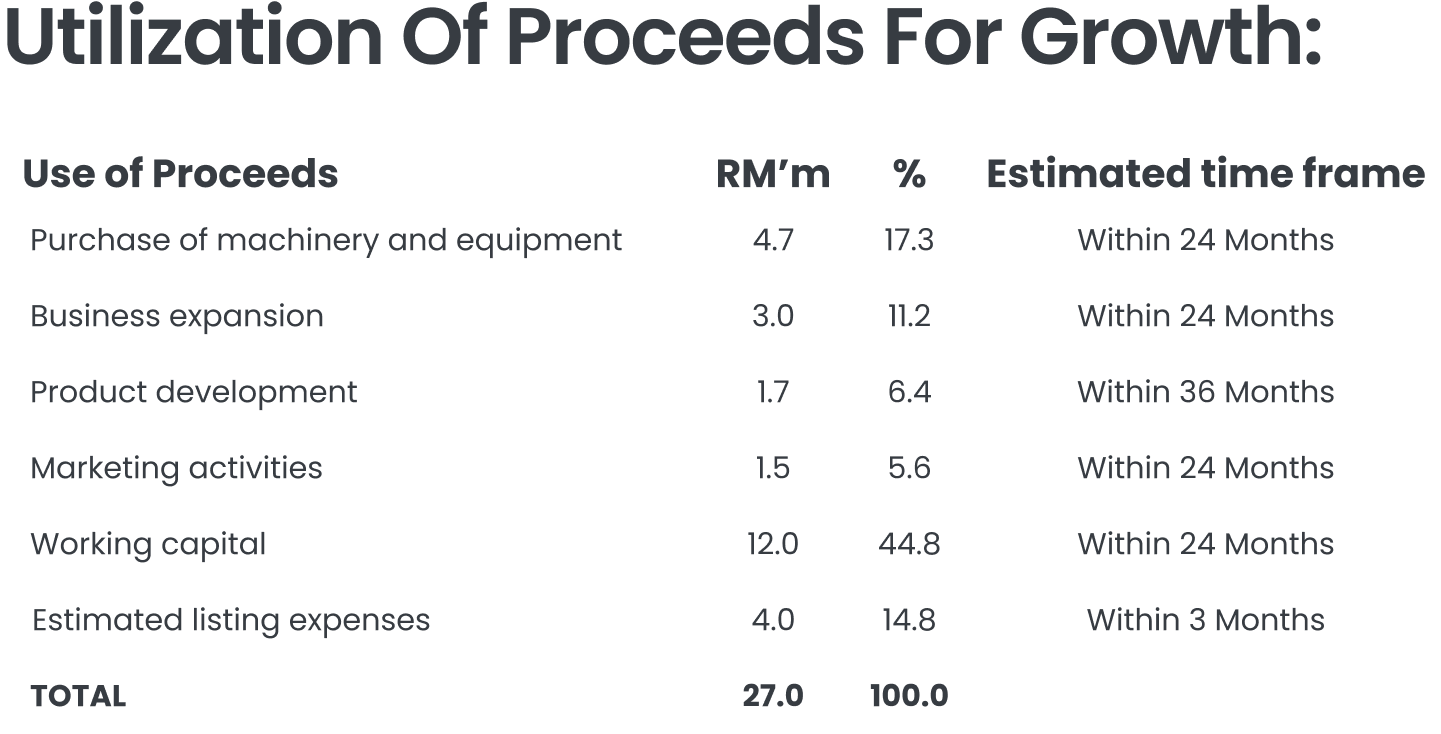

The Group intends to purchase machinery and equipment to strengthen its in-house capability for manufacturing cleanroom fixtures and related products, supporting both its core cleanroom services and other facility services. It also intends to set up a new facility near the Mantin Factory to increase storage capacity for materials and finished products. Additionally, the Group plans to hire 15 engineers to enhance in-house engineering support for project implementation and manufacturing operations.

- Geographical market expansions.

To support its business expansion, iCents intends to incorporate a new subsidiary in Indonesia and establish a sales and technical support office in Jakarta. The Group also intends to incorporate a new subsidiary in Singapore and set up a sales and marketing office there, along with a new sales and technical support office in Kuching, Sarawak.

- Expand product range and addressable market.

The Group plans to carry out product development to expand its product range by modifying and enhancing existing cleanroom fixtures to better suit targeted applications. It also intends to obtain patent registrations for some of the new products developed in countries such as Malaysia, Singapore, Australia, Vietnam, and Indonesia.

- Expand sales and marketing activities.

The Group plans to increase its participation in exhibitions in Malaysia and overseas, including Australia, Singapore, and Vietnam. The Group also aims to expand its sales and marketing efforts by enhancing its website with e-commerce functionality and implementing search engine optimization.

M+ Fair Value

We ascribe a fair value of RM0.30 for ICENTS Group Holdings Berhad. Our valuation is derived by pegging a forward P/E of 13x to the forecasted FY26 EPS of 2.30 sen, implying a 25% upside from its IPO price of RM0.24. While there are no identical peers to ICENTS, most of the comparable companies we gathered are closely linked to the data centre supply chain. Although we pegged the P/E at a discount of 10.3-14.5% against the average historical and forward P/E of 14.5-15.2x, we believe this fairly reflects ICENTS’ smaller market capitalization.