Hartanah Kenyalang Berhad IPO - Upside Potential of 37.5%

Future Plans for Growth:

- Expansion of building and infrastructure construction activities in Sarawak.

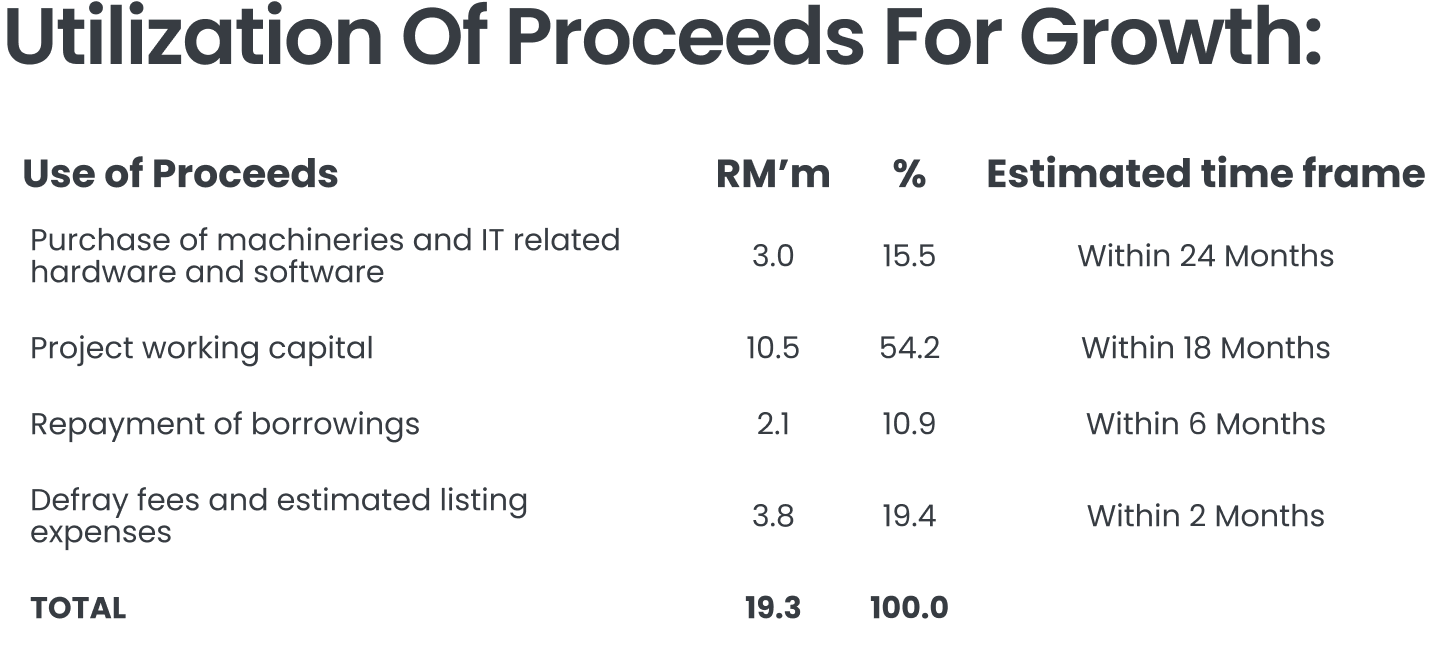

The group intends to deepen its presence in Sarawak’s construction industry by actively bidding for new building and infrastructure contracts, with a focus on substations, government-related institutional buildings, high-rise developments, roads, and bridges. Leveraging its track record on projects such as the State Archive Project and Sebauh Bridge Project, the group aims to grow its project pipeline. To support this strategy, RM10.5 million (54.2% of IPO proceeds) has been earmarked as working capital for upcoming construction projects.

- Purchase of construction machinery and IT systems.

The group plans to acquire six new excavators to replace aging equipment and boost capacity for ongoing and future projects. RM2.7 million (14.0% of IPO proceeds) will be allocated for these purchases, to be completed over a 24-month period. An additional RM0.3 million (1.5% of IPO proceeds) will be used for IT upgrades, including new computers, software subscriptions, cloud storage services, and Building Information Modeling (BIM) tools to improve project planning, integration, and disaster recovery capabilities.

- Expansion into design and build construction services.

The group aims to secure more design and build projects by offering end-to-end solutions for both building and infrastructure construction. This expansion builds on past experience incorporating design elements in projects such as Sekolah Daif. To support this initiative, RM0.1 million (0.5% of IPO proceeds) will be invested in BIM technology, with staff training already underway. As at the LPD, the group has tendered for four projects worth a combined RM220.0 million, including one RM80.0 million design and build project.

M+ Fair Value

We assign a fair value of RM0.22 per share for HKB, representing a 37.5% upside from its IPO price of RM0.16. This valuation is based on a P/E ratio of 11.5x, pegged to the mid-FY26F EPS of 1.91 sen. We believe the ascribed P/E is justified, given the average P/E and forward P/E among its peers range between 11.5x and 12.7x. Despite its stronger ROE of 40.0% compared to its peers’ average of 7.9%, the P/E ratio is tilted to the lower-end due to its relatively smaller market cap and lower net profit margin.