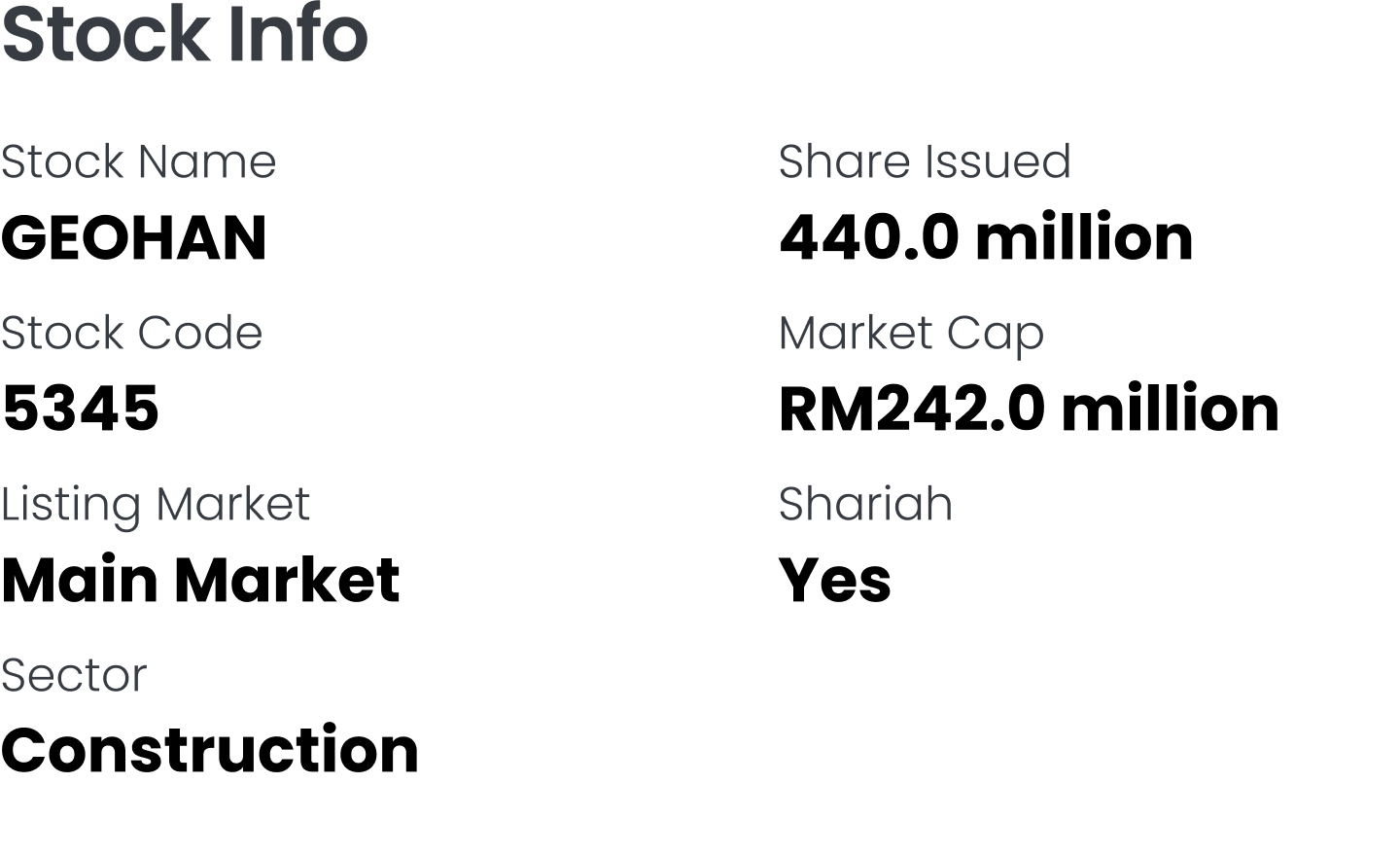

Geohan Corporation Berhad - Upside Potential of 20.0%

Future Plans for Growth:

- Expanding the machinery fleet to enhance operating capacity

Geohan Group plans to expand its fleet of machinery and equipment to support its growing order book of RM390.39m and sustain its strong revenue growth trajectory. The Group intends to purchase additional rotary boring rigs, crawler cranes, and excavators to increase its bored piling operating capacity by approximately 10% to 15%. This expansion will reduce dependence on third-party rentals, lower operational costs, and improve efficiency by enabling better resource allocation across multiple concurrent projects. By strengthening its fleet, Geohan aims to minimise project delays, maintain flexibility in deployment, and ensure uninterrupted operations even during equipment downtime, thereby enhancing competitiveness and supporting continued business growth. The group plans to allocate a total of RM40m from the IPO proceeds to purchase the machinery and equipment.

- Expanding customer reach and establishing presence in Singapore

Building on its success in Malaysia, Geohan Group aims to re-enter and establish a sustainable presence in the Singapore market by offering foundation and geotechnical services, particularly bored piling works. The Group has already obtained the Specialist Builder (Piling Works) license and CRS registration from the Building and Construction Authority (BCA) to qualify for project tenders. To facilitate operations, Geohan plans to set up a local sales and administrative office in Singapore by early 2026 and deploy a dedicated team of around 20 employees. With its proven expertise and growing regional demand, the Group seeks to capture new business opportunities in Singapore’s expanding construction sector, strengthening its regional footprint and long-term growth prospects. This expansion will cost approximately RM5.3m and will be fully funded via internally generated funds.

M+ Fair Value

We assign a fair value of RM0.66 per share for GEOHAN, representing a 20.0% upside from its share price of RM0.55. This valuation is based on a P/E ratio of 14.0x, pegged to the FY26 EPS of 4.69 sen.

While the average 12-months forward P/E and historical P/E multiples of its peers stood at 17.2x to 63.7x, with a median of 17.1x to 20.6x, we assign GEOHAN a P/E multiple of 14.0x to account for its relatively smaller market capitalisation against its peers.