Foodie Media Berhad - 56.7% Potential Upside

Future Plans for Growth:

- Continue growing digital media publishing, KOL marketing, and campaign management service segments.

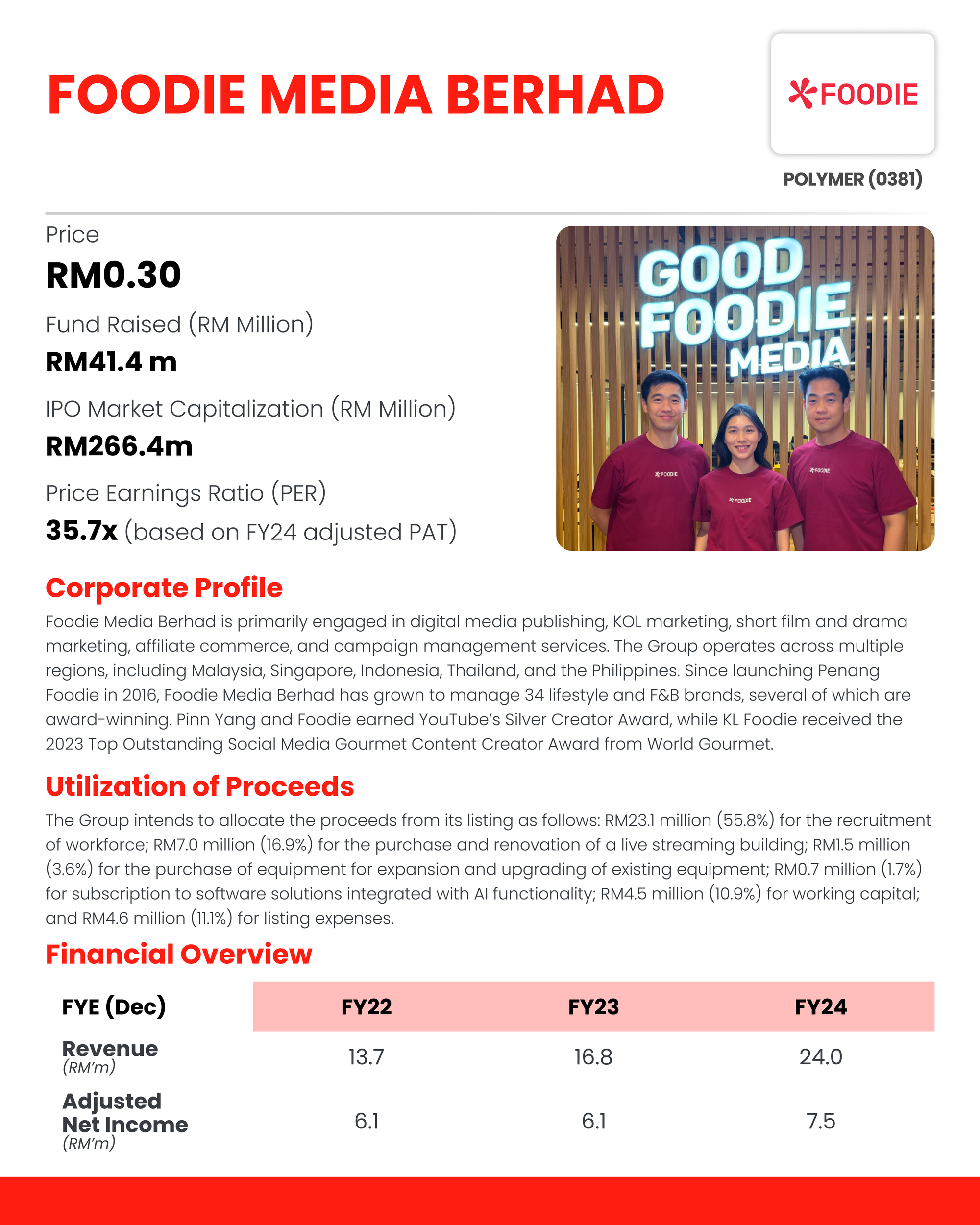

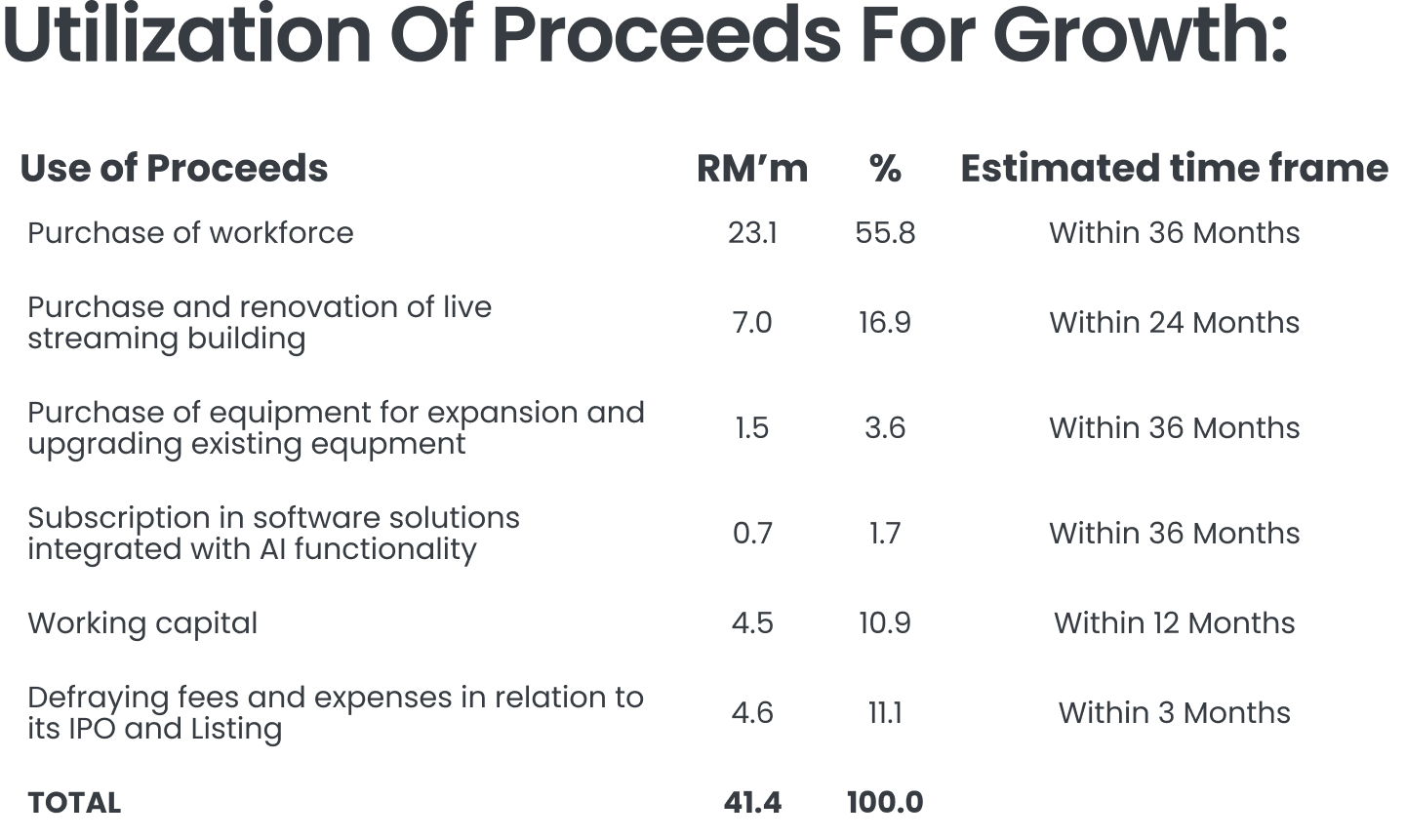

Foodie Media Berhad intends to strengthen its digital media publishing, KOL marketing, and campaign management service segments through workforce expansion, technology adoption, and brand development. The Group plans to recruit up to 137 new personnel across content production, KOL management, IT, and administration over 36 months, supported by RM17.9 million from the Public Issue proceeds. To support production activities, approximately RM1.3 million will be utilised to acquire video and photo shooting equipment. The Group also plans to implement an AI-integrated social media management solution costing RM0.7 million and develop up to five new brands, with RM4.5 million allocated for advertisement boosting and related working capital.

- Grow revenue from live commerce selling.

Foodie Media Berhad aims to capture growth opportunities in the live commerce segment by expanding its operational capacity and workforce. The Group plans to acquire and renovate a new property in the Klang Valley to establish up to 30 live streaming rooms, with total estimated costs of RM6.8 million, funded via Public Issue proceeds. Additionally, up to 47 new live hosts and co-hosts will be recruited over three years at an estimated cost of RM4.1 million. To enhance audience reach and visibility of live sessions, RM4.5 million from the Public Issue proceeds will be allocated for advertisement boosting and working capital purposes.

- Produce own short-film dramas.

Foodie Media Berhad plans to produce its own short-film dramas to diversify content offerings and strengthen creative capabilities. Producing in-house short-film dramas will allow the Group greater creative control, shorter production timelines, and improved profit margins. The Group intends to recruit up to six film production personnel, including a director, videographers, editors, and assistants, by end-2025 at an estimated cost of RM1.1 million, funded via Public Issue proceeds. Approximately RM0.155 million will also be utilised to acquire new production and shooting equipment such as digital cameras, drones, lighting kits, and stabilisers to support the production of high-quality short-film dramas.

M+ Fair Value

We assign a target PER of 28x based on FY26F EPS, translating into a fair value of RM0.47 per share. While this multiple sits above the 2-year average PER of FBMSCAP, we believe FOODIE warrants a 40.0% premium against its peer average P/E of 17.7x given its strong EPS growth of 51.1%/32.1%/34.7% over the next three years, combined with its solid brand profile as well as its decent net margin of 31.1% versus the peer average of 12.2%.