PMW International Berhad - Upside Potential of 67.6%

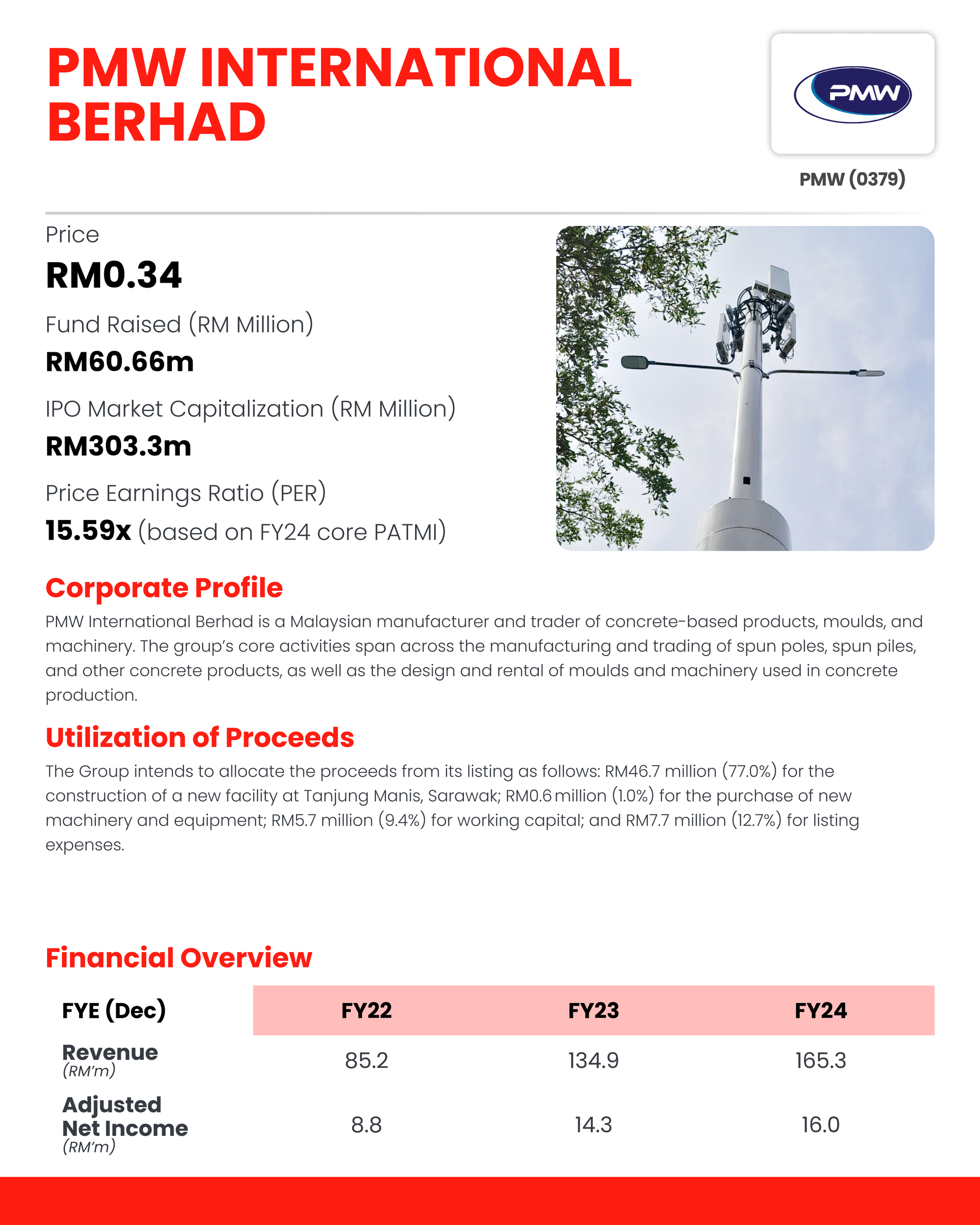

Future Plans for Growth:

- Construction of a new facility in Tanjung Manis, Sarawak

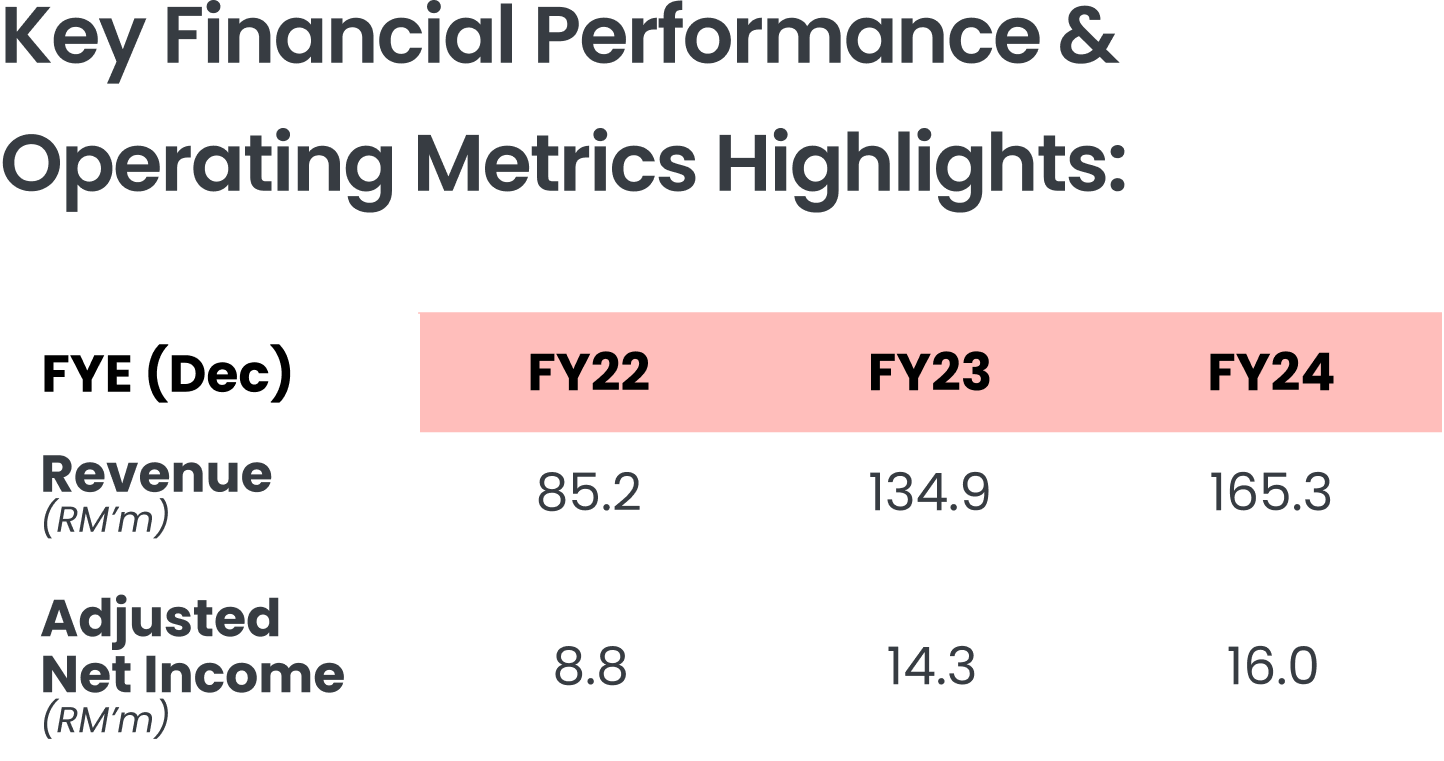

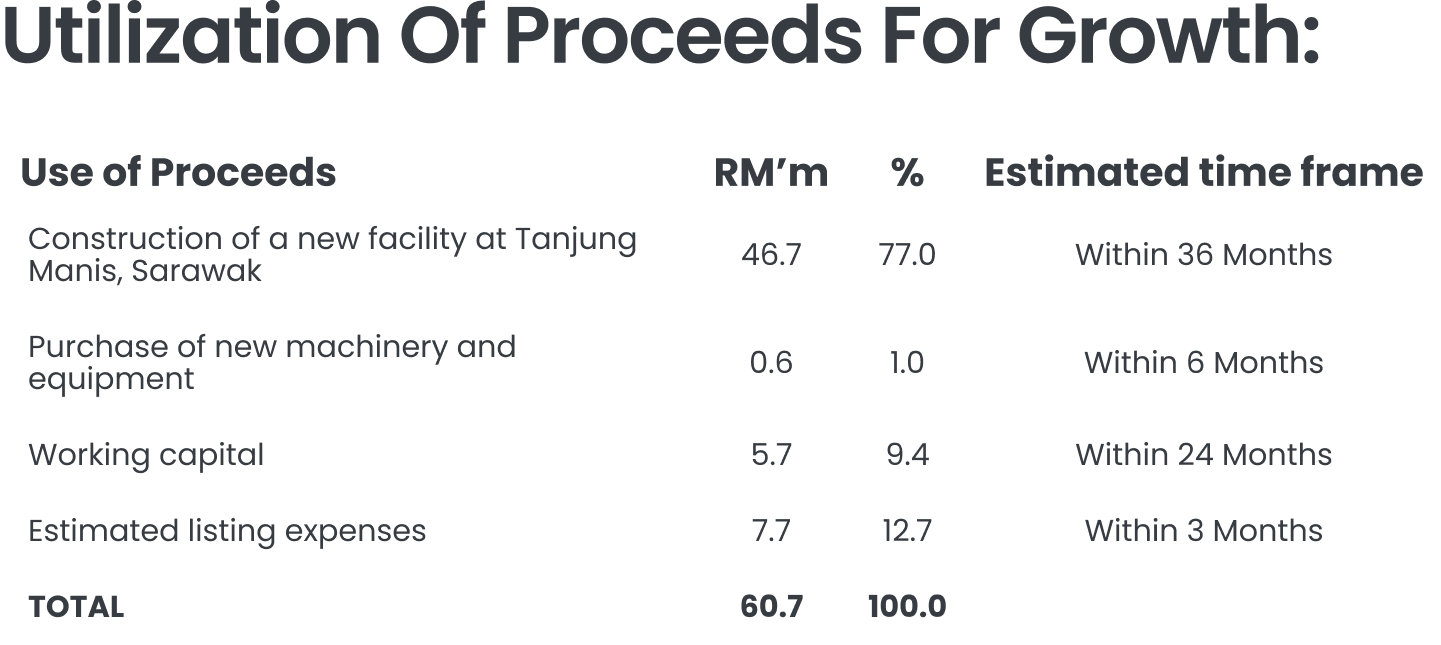

PMW plans to construct a new spun poles and piles manufacturing facility in Tanjung Manis, Sarawak, to better serve customers in East Malaysia and capture regional infrastructure demand. A total of RM46.7m (77.0% of IPO proceeds) will be allocated for this initiative. The new facility, with a total built-up area of 60,900 sqft, will have an annual capacity of 122,000 tonnes of spun piles and 6,200 tonnes of spun poles. The project will be undertaken via a joint venture with Sarawak Timber Industry Development Corporation (STIDC), which will participate through the injection of industrial land in Tanjung Manis.

- Purchase of new machinery and equipment

To support capacity expansion and improve production efficiency, PMW will allocate RM0.6m (1.0% of IPO proceeds) to purchase a new laser cutting machine and shovel loader. The new laser cutting machine will accelerate the cutting cycle time for steel materials used in mould manufacturing, while the additional shovel loader will eliminate downtime caused by equipment sharing between factories.

M+ Fair Value

We assign a fair value of RM0.57 per share for PMW, representing a 67.6% upside from its share price of RM0.34. This valuation is based on a P/E ratio of 20.0x, pegged to the FY26 EPS of 2.85 sen. We believe the ascribed P/E multiple is fair, given that the average 12-months forward P/E and historical P/E multiples of its peers stood at 19.9x to 20.4x.