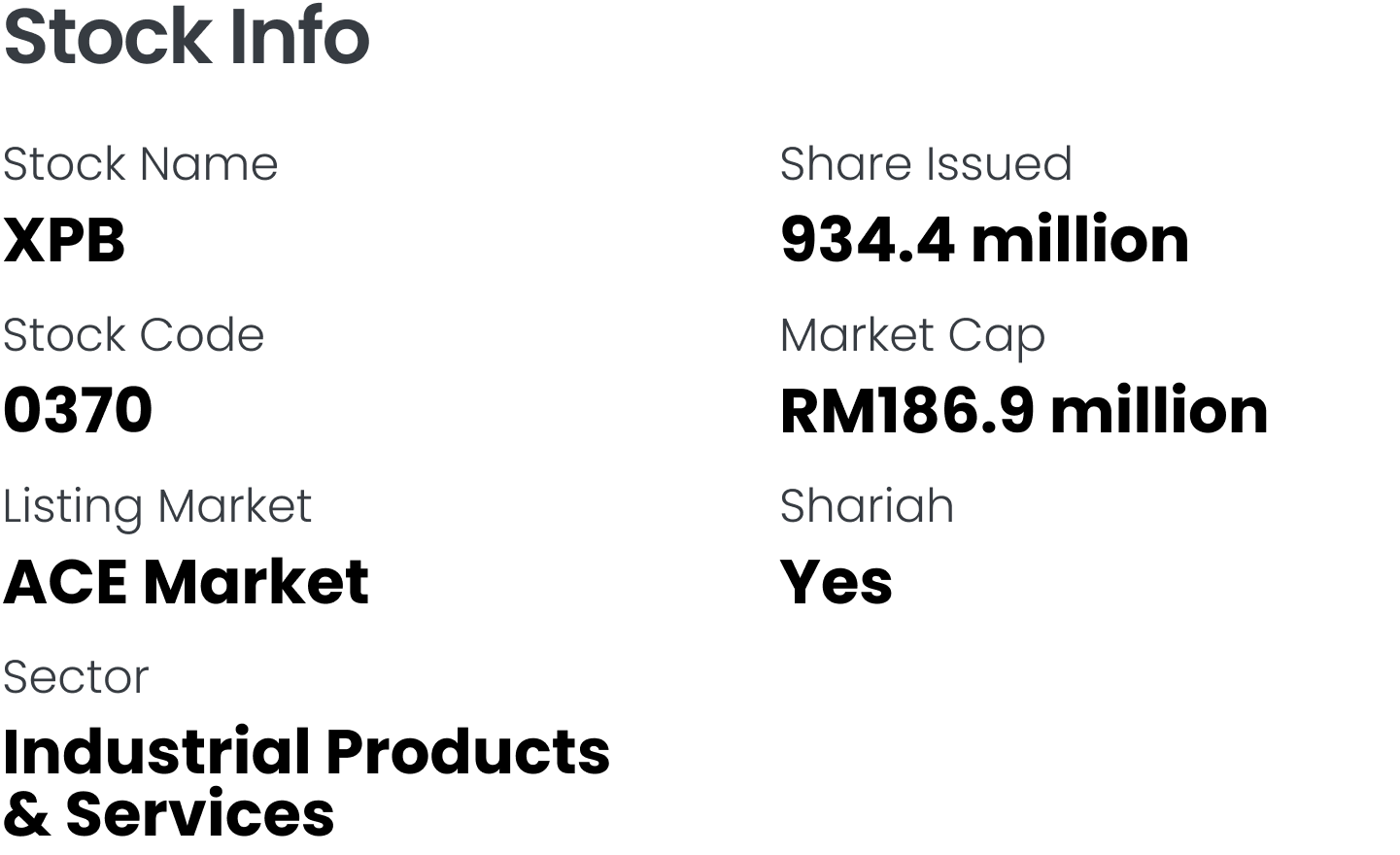

Express Powerr Solutions Berhad - Upside of 55.0%

Future Plans for Growth:

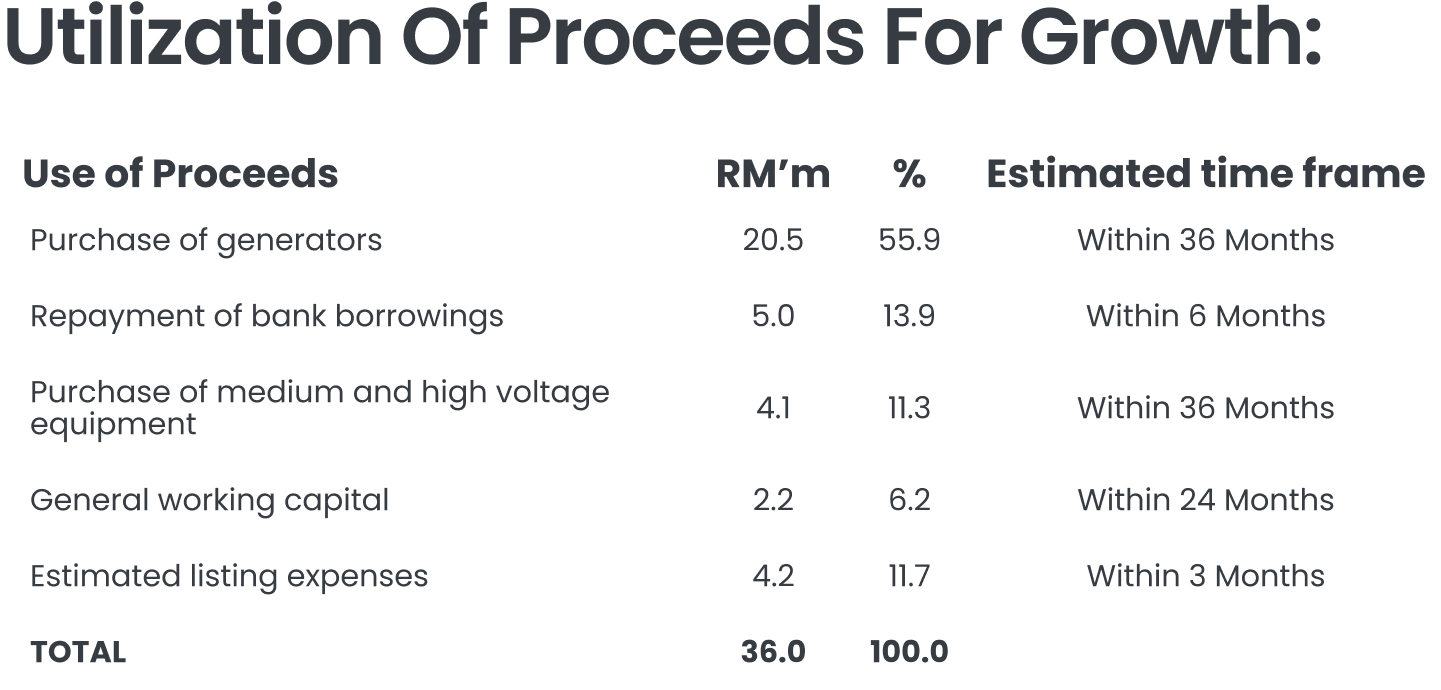

- Purchase of new generators.

The group plans to expand its fleet of generators along with acquiring medium- and high-voltage equipment, to meet rising demand, increase operational capacity, and support both current and new customers more effectively. This is also aligned with the Group’s intention to tap into new segments such as oil and gas, thereby lowering customer concentration risk.

- Establishing new Headquarters.

To support its growing operations, the group is in the process of setting up a new headquarters and operations yard. The construction, expected to be completed by the third quarter of 2025, involves new buildings purchased in December 2022. These facilities will replace the existing HQ in Klang, Selangor, and provide greater capacity, modern infrastructure, and operational efficiency.

- Expanding into Solar PV solutions.

In line with sustainable growth objectives, the group is venturing into renewable energy, focusing on solar photovoltaic (PV) solutions. Moving forward, the Group plans to involve partnering with local solar providers to deliver rooftop solar PV installations for both residential and commercial customers.

M+ Fair Value

We assign a fair value of RM0.31 per share for XPB, representing a 55.0% upside from its IPO price of RM0.20. The valuation is based on a P/E ratio of 15.0x, pegged to the mid-FY26F EPS of 2.05 sen.

While there are no directly comparable local listed peers in XPB’s niche segment, we believe XPB will command a valuation similar to companies in TNB’s value chain and related companies like MNHLDG, UUE, JTGROUP, PWRWELL, and SCGBHD as XPB is viewed as a key proxy for TNB. They are trading around 15.4x-18.2x for the forward and historical P/E, respectively.

Moreover, since there are no comparable listed peers, we have also benchmarked XPB against the global peers that have exposure towards light machinery industry which may serve as a reference for future rerating catalysts. These global peers are trading at P/E ratios of around 19.8-21.6x.