Enproserve Group Berhad

Future Plans for Growth:

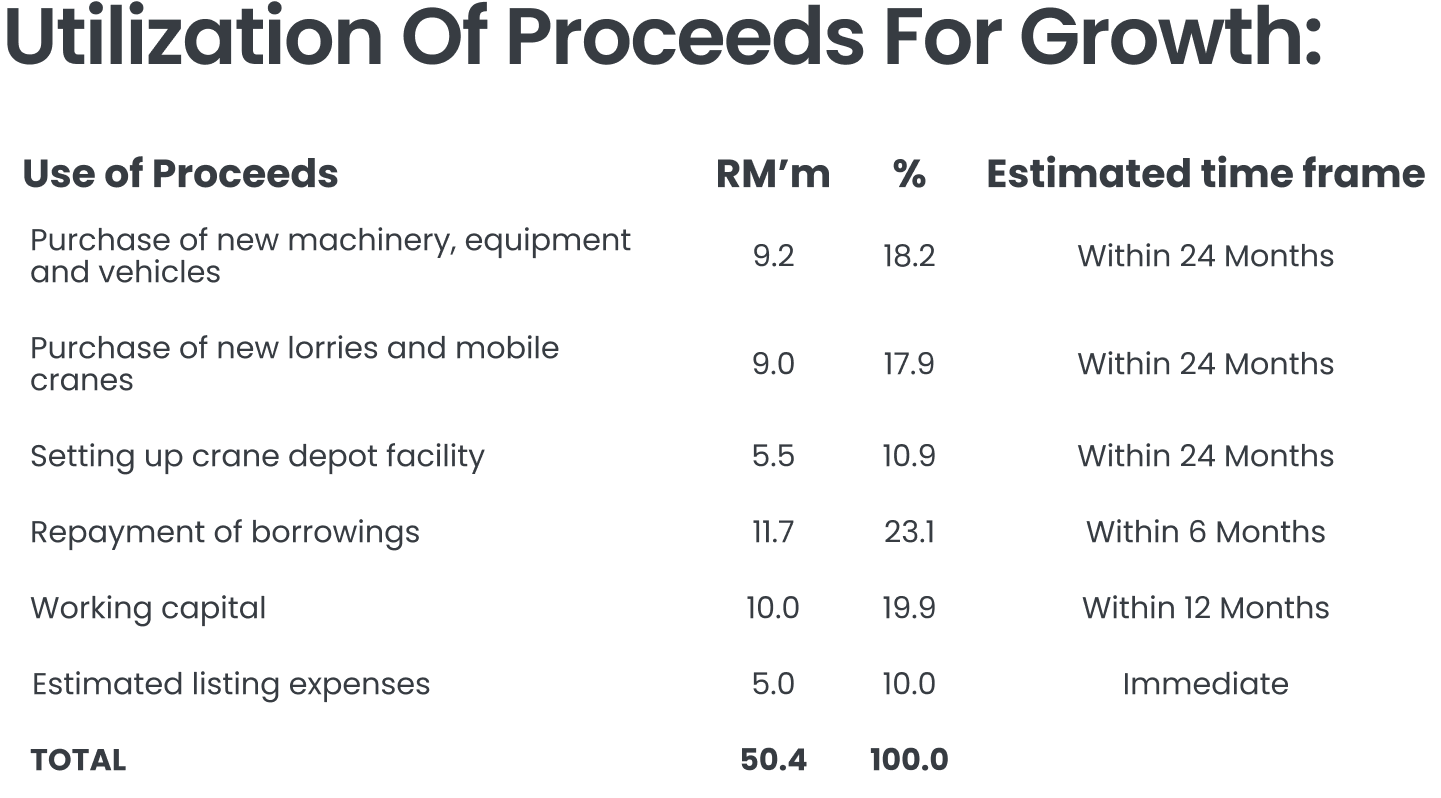

- Purchase of new machinery.

Enproserve plans to allocate RM9.2m (18.2% of IPO proceeds) to acquire vacuum trucks, dozers, flange facing machines, valve servicing equipment, hydraulic tube bundle extractors, and high-pressure water jetting machines to support its growing portfolio of long-term maintenance contracts across Johor, Melaka, Terengganu, and Pahang. The move aims to reduce reliance on external rentals and subcontractors, while also enhancing efficiency and readiness for potential execution works at PETRONAS’ Pengerang refinery complex.

- Fleet expansion for rental and maintenance contracts.

To fulfil its 7 newly secured 3-year rental contracts from 2023 to 2026 (with 2-year extension options) from the PETRONAS Group, Enproserve will acquire one 500-tonne mobile crane and four low loaders. The equipment will serve both its rental segment and internal turnaround works, improving deployment flexibility and reducing dependence on third-party rentals, especially for high-tonnage cranes often required during heavy lifting phases. This strategy builds on its RM34.5m investment into 21 cranes since July 2024 and supports estimated demand of up to 40-50 cranes for upcoming TA4MS jobs.

- Setting up a new crane depot in Paka, Terengganu.

The Group will also construct a dedicated crane depot and workshop on a 1-acre industrial land in Paka to centralise crane servicing, maintenance, and storage. Strategically located near key clients in Terengganu, Pahang, and Kedah, the facility is expected to be operational by 2Q26. It complements an existing laydown area within the Pengerang Integrated Complex, supporting mobilisation to Johor-based sites. Land acquisition has been 80% completed via internal funds, with RM5.5m IPO proceeds earmarked to fund the depot’s development.

M+ Fair Value

We assign a fair value of RM0.31 per share for ENPRO, representing a 29.2% upside from its IPO price of RM0.24. This valuation is based on a P/E ratio of 13.5x, pegged to the mid-FY26F EPS of 2.33 sen.

The ascribed P/E multiple is higher than that of its peers in the oil and gas equipment and services sub-industry under the Bursa Malaysia Energy Index (KLENG), which trade at an average historical and forward P/E of 8.0x to 8.9x. We believe the premium is justified, given that ENPRO boasts a higher ROE and NP margin of 42.0% and 10.6% respectively, compared to its peers' average of 20.4% and 9.1%.

It is worth noting that the assigned P/E multiple has the potential for an upward rerating. Currently, the valuation appears to be influenced by broader market conditions, specifically liquidity in the local bourse. Once liquidity improves, we anticipate a rerating of ENPRO's valuation, bringing it more in line with its closest peers, DIALOG and HAWK. This potential for rerating is further supported by the company's strong fundamentals.