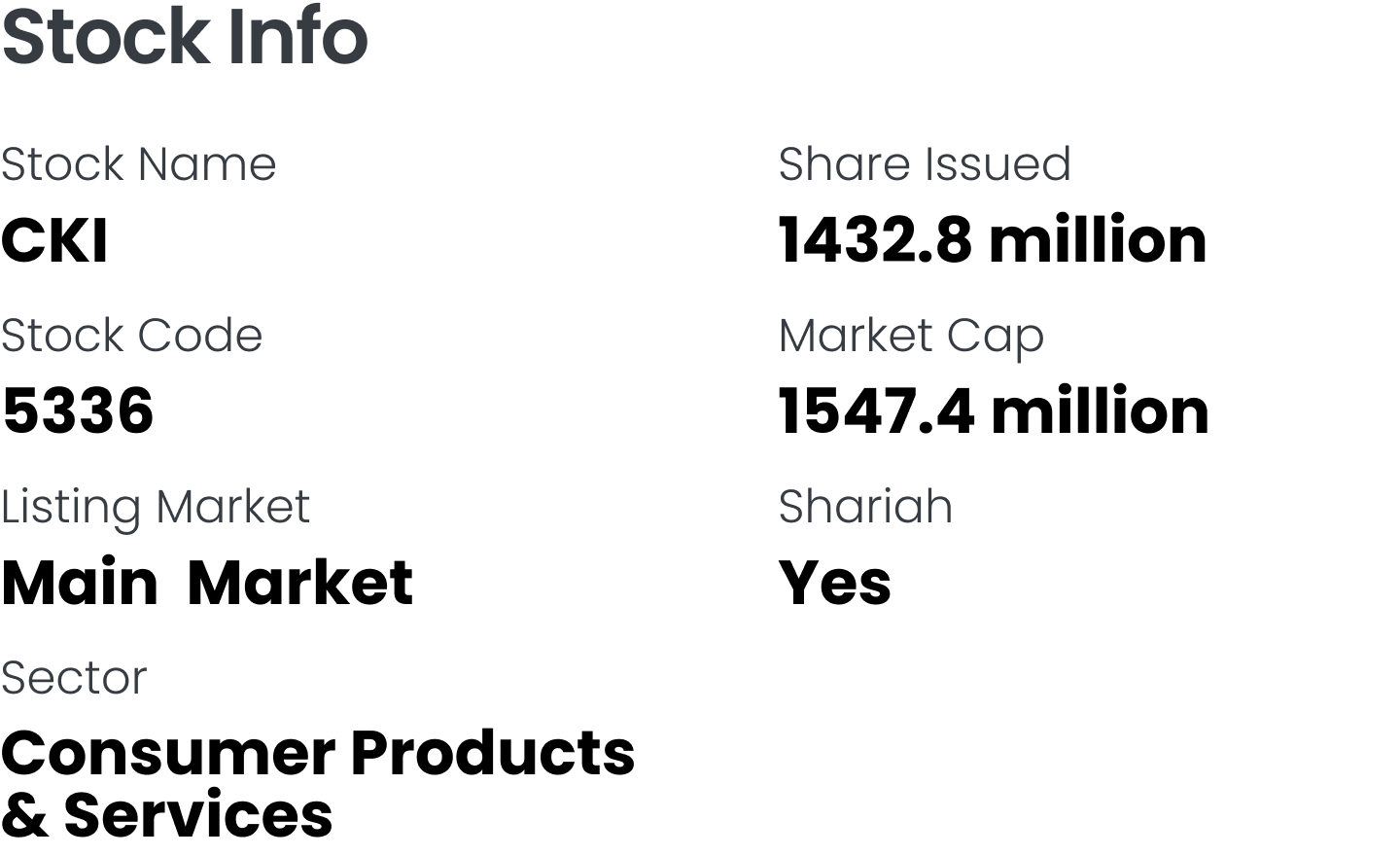

CUCKOO International (MAL) Berhad IPO - Upside of 41.7%

Future Plans for Growth:

- Product portfolio expansion to drive market growth.

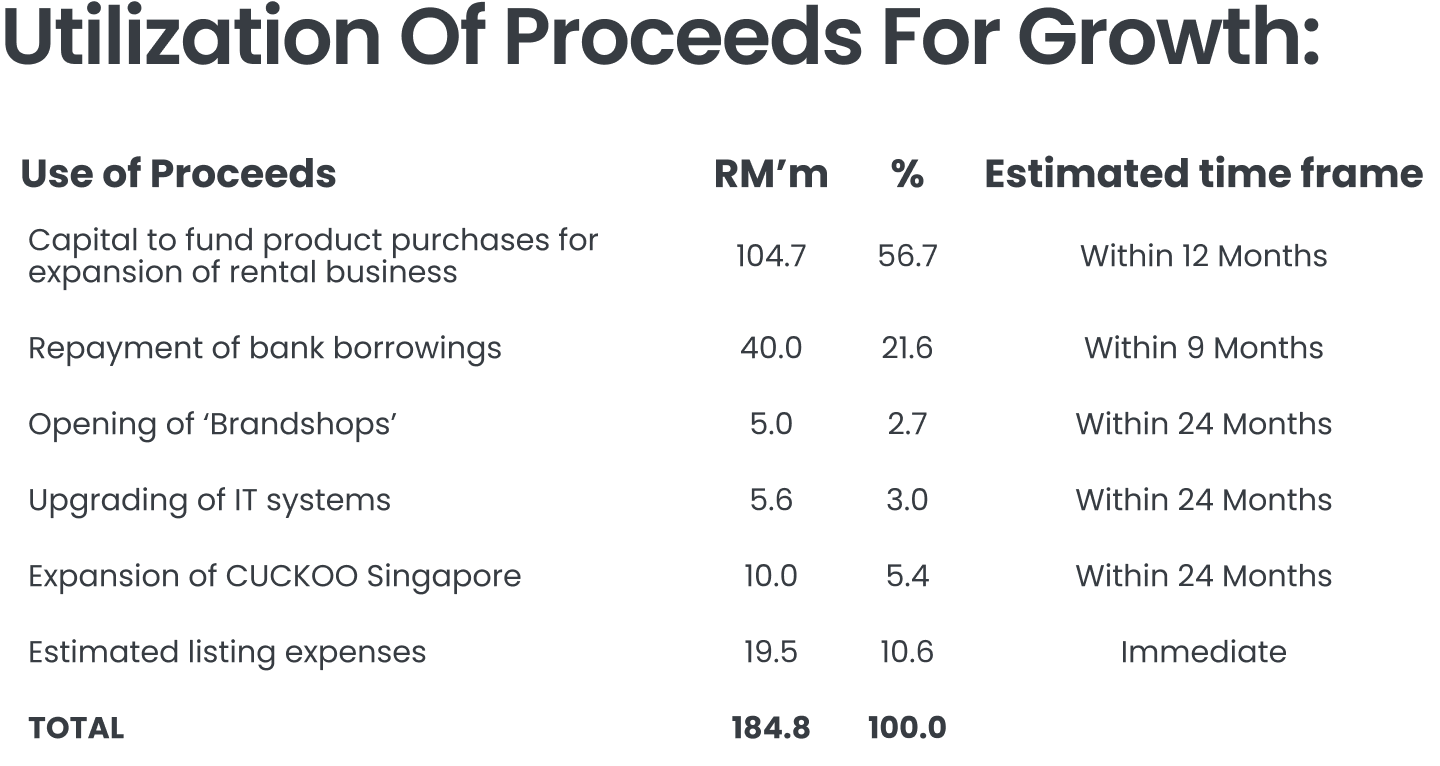

The group plans to broaden its product and service offerings through the expansion of rental business in order to capture a larger market share in Malaysia’s growing home appliance and household goods rental industry. As of the LPD, the group offers 54 CUCKOO-branded SKUs, 10 CUCKOO Co-Created SKUs, 34 SKUs under WonderLab and WonderDewi, and 8 WonderKlean service packages. RM104.7m (56.7% of IPO proceeds) will be allocated as capital to fund product purchases for the group’s expansion of rental business.

- Opening of CUCKOO Brandshops.

The group plans to launch 10 "cash and carry" CUCKOO Brandshops over the next two years, expanding its omni-channel distribution network. Three brandshops in Kuala Lumpur, Penang and Johor this year, and seven such brandshops in Sabah, Selangor, Melaka, Perak, Kedah, Kelantan and Terengganu in 2026. RM5.0m (2.7% of IPO proceeds) will be allocated for the expansion.

- Stronger presence in Singapore.

The group plans to expand CUCKOO Singapore by allocating RM10.0m (5.4% of IPO proceeds) to support sales distribution network expansion, marketing campaigns, and product diversification. This investment will reinforce the group's regional presence and growth strategy.

- Strengthening IT infrastructure for operational efficiency.

The group will be allocating RM5.6m (3.0% of IPO proceeds) to upgrade its IT systems by enhancing its warehouse management system, setting up a physical server, and improving cloud capabilities.

M+ Fair Value

We assign a fair value of RM1.53 per share for CKI, representing an 41.7% upside from the IPO price of RM1.08. This valuation is based on a P/E ratio of 14.0x, pegged to mid-FY26f EPS of 10.96 sen. We believe the ascribed PE is fair as the peer average P/E and forward P/E ratio stood at 11.8-20.1x. On top of that, CUCKOO showed an impressive ROE and NP margin of 13.0% and 9.0%, outperforming its peers’ average of 0.6% and 0.1% respectively.