THMY Holdings Berhad - Upside Potential of 58.1%

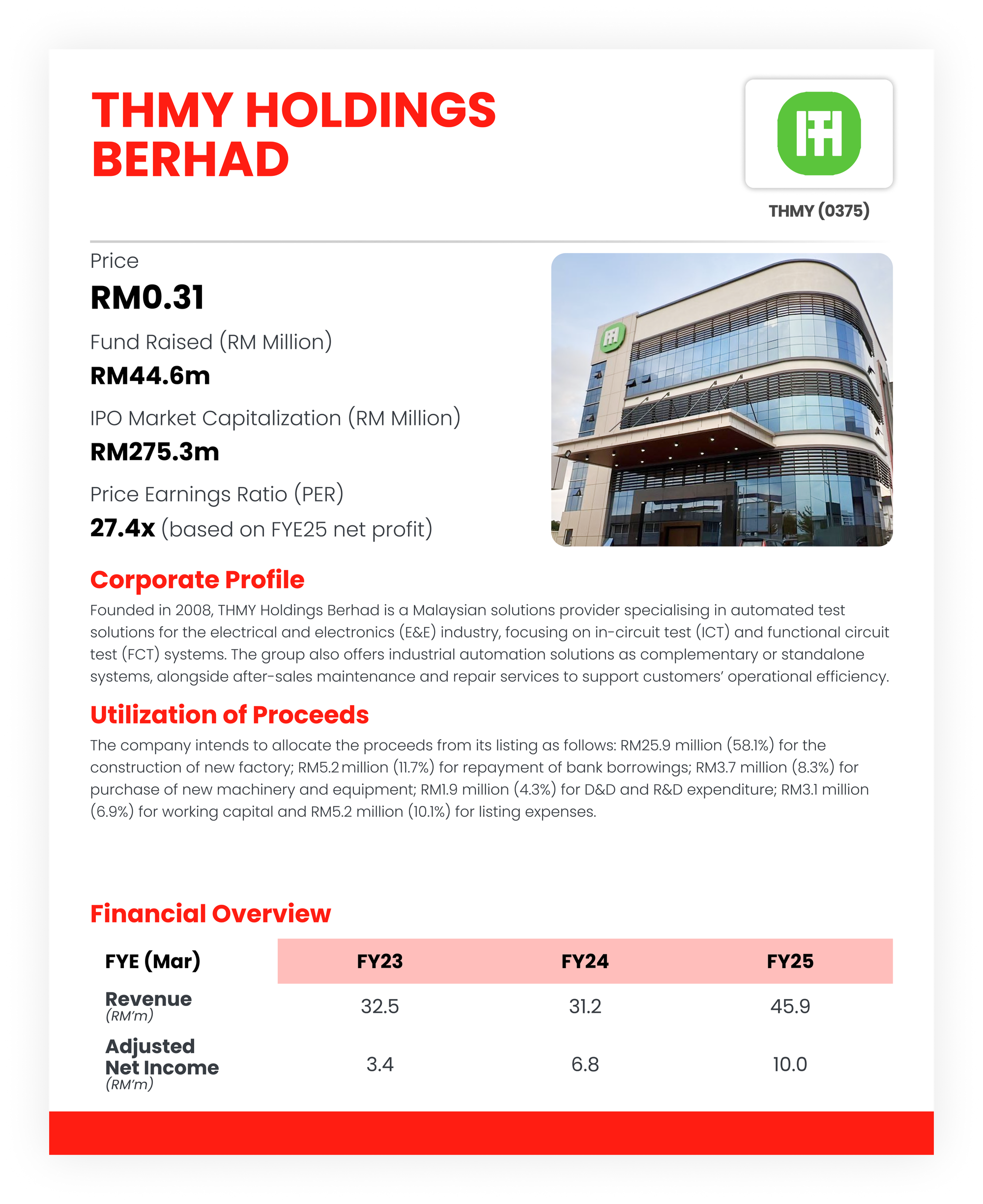

Future Plans for Growth:

- Construction of a new factory to increase production capacity.

The group plans to allocate RM25.9m (58.1% of IPO proceeds) to construct a new 88,000 sq ft facility near its existing Batu Kawan factory, with 70,000 sq ft allocated for production and 20 FCT assembly workstations. This expansion will support entry into the technology, media and telecommunications industry, which requires larger-scale, high-volume FCT solutions. The new factory will also house training rooms and employee welfare facilities.

- Purchase of new machinery and equipment.

To complement the expansion at the Batu Kawan factory, THMY will acquire new machinery and equipment to support the increase in assembly workstations from 7 to 15. This will enhance fabrication capabilities for test fixtures and tester platforms, improving production efficiency. RM3.7m (8.3% of IPO proceeds) will be allocated for it.

- Investment in D&D and R&D.

The group intends to strengthen its solution offerings by investing RM1.9m (4.3% of IPO proceeds) in 36 new software and equipment units, including AMRs, robotic arms and wireless PCBs. In addition, five engineers will be hired to further support D&D and R&D initiatives, enabling continuous improvement and innovation.

- Expansion into Thailand with a new support office.

To cater to growing demand from its Thailand customer base, which contributed up to 27.7% of revenue in FYE2025, the group plans to establish a support and maintenance office in Si Racha, Chonburi or Amata by 1Q2026. The office will be staffed with four engineers and one administrative personnel, allowing THMY to provide timely services and strengthen relationships with Thai customers. RM0.51m will be utilised from the IPO proceeds.

M+ Fair Value

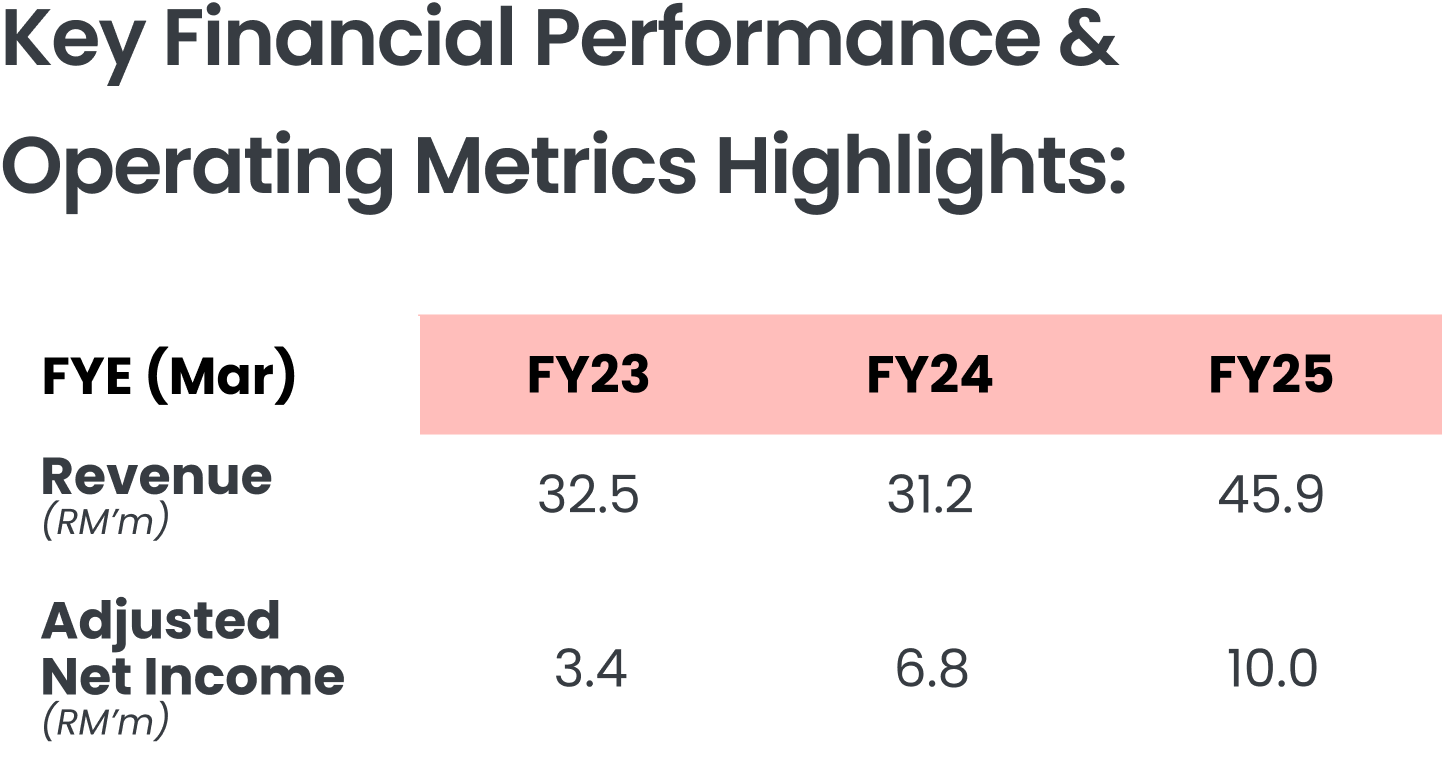

We assign a fair value of RM0.49 per share for THMY, representing a 58.1% upside from its IPO price of RM0.31. This valuation is based on a P/E ratio of 24.8x, pegged to the mid-FY27F EPS of 1.98 sen.

Global peers are trading at forward and historical P/E multiples of 30.5x–148.3x, while local peer Aimflex Berhad is trading at 41.7x. Excluding Zhuhai Bojay Electronics (an outlier with inflated valuation but weak NP margin), the average multiple for both local and global peer narrows to 28.9x–30.5x.

We ascribe THMY a P/E ratio of 24.8x, which implies a fairly valued PEG ratio of 1.0 given core PAT’s forecasted CAGR of 24.8% over FY25–28f. Notably, the assigned P/E multiple is still below the peer average despite THMY delivering stronger ROE and NP margin, suggesting potential valuation upside should the market re-rate the stock in line with its superior fundamentals.