Camaroe Berhad - Upside Potential of 21.4%

Future Plans for Growth:

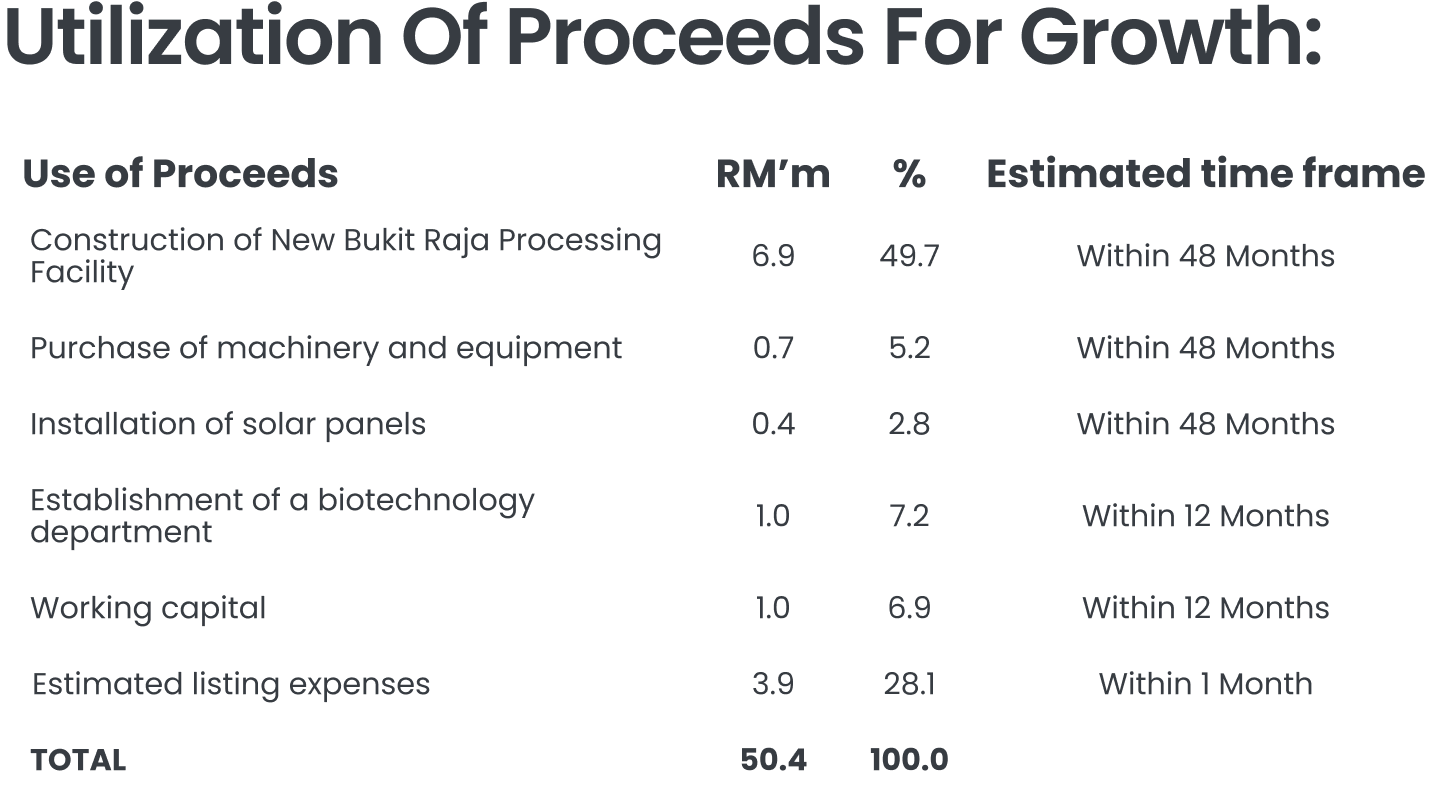

- Construction of New Bukit Raja Processing Facility.

Camaroe plans to build a new processing plant in Bukit Raja to replace its existing Kapar facility, with relocation targeted by 1Q29. The new facility will feature upgraded processing lines, chest freezers, and a rooftop solar system, aimed at expanding production capacity, improving operational efficiency, and supporting long-term growth in export markets. A total of RM8.0m (57.7% of IPO proceeds) will be allocated for the construction.

- Establishment of an in-house biotechnology department.

To enhance its farming efficiency and product quality, the group will set up an in-house biotechnology department by 2Q25 at its Kapar facility, relocating it to Bukit Raja by 1Q29. The department will focus on R&D and laboratory testing, particularly in probiotics and farming supplements, requiring investment in specialised equipment and recruitment of a research scientist and two lab technicians. RM1.0m (7.2% of IPO proceeds) will be allocated for it.

M+ Fair Value

We assign a fair value of RM0.17 per share for CAMAROE, representing a 21.4% upside from its IPO price of RM0.14. This valuation is based on a P/E ratio of 11.0x, pegged to the mid-FY27F EPS of 1.56 sen.

Although the average forward P/E and historical P/E multiple among its peers trade between 9.7x to 19.7x, we treat SBH Marine Holdings Berhad as an outlier given its high premium valuation with relatively lower NP margin. Hence, excluding SBH Marine Holdings Berhad, the average forward P/E and historical P/E multiple among CAMAROE’s peers trade between 9.7x to 10.4x. We ascribe a P/E of 11.0x to CAMAROE, given its solid NP margin compared to all of its peers.