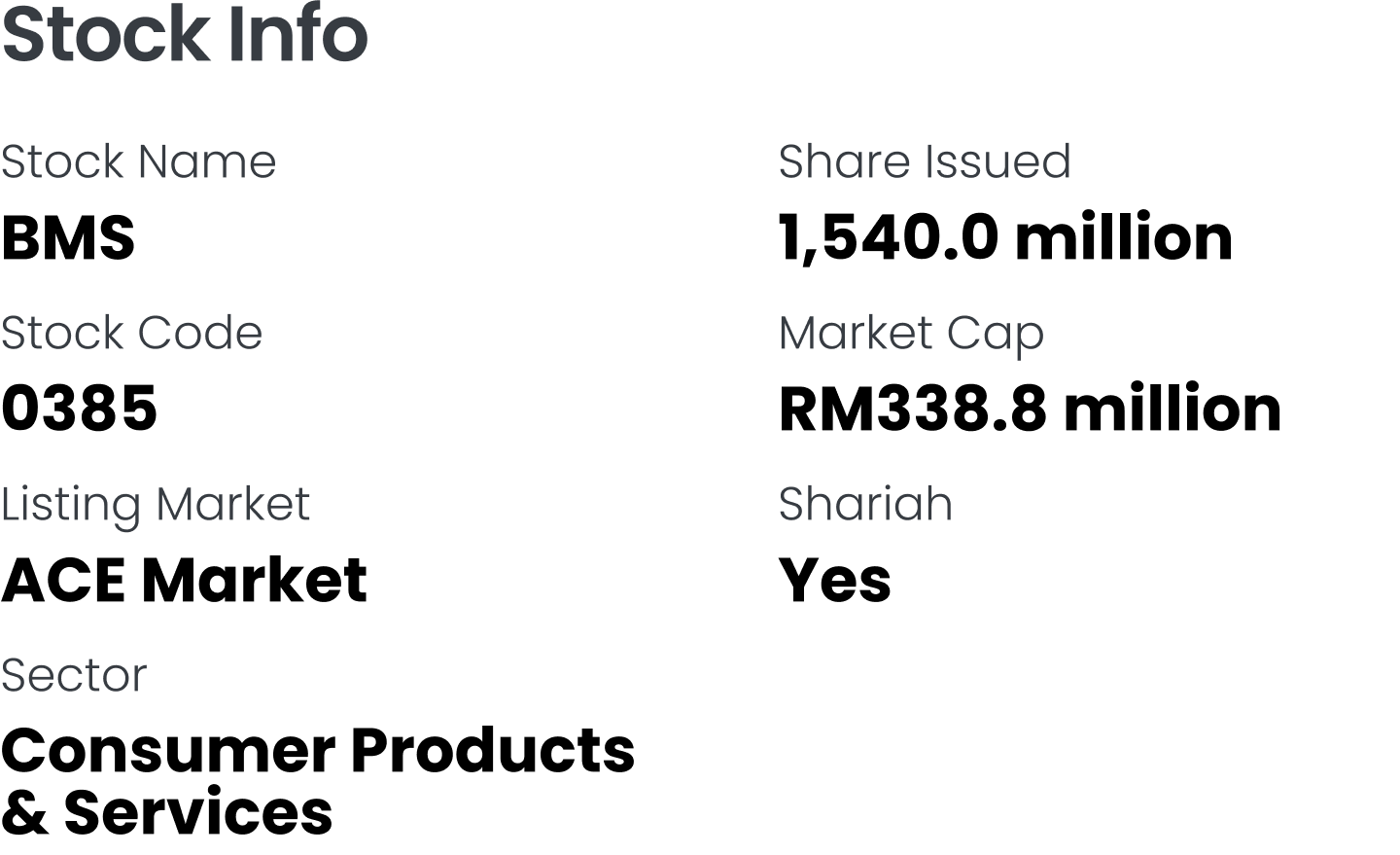

BMS Holdings Berhad - 13.6% Potential Upside

Future Plans for Growth:

- Setting up new retail showrooms

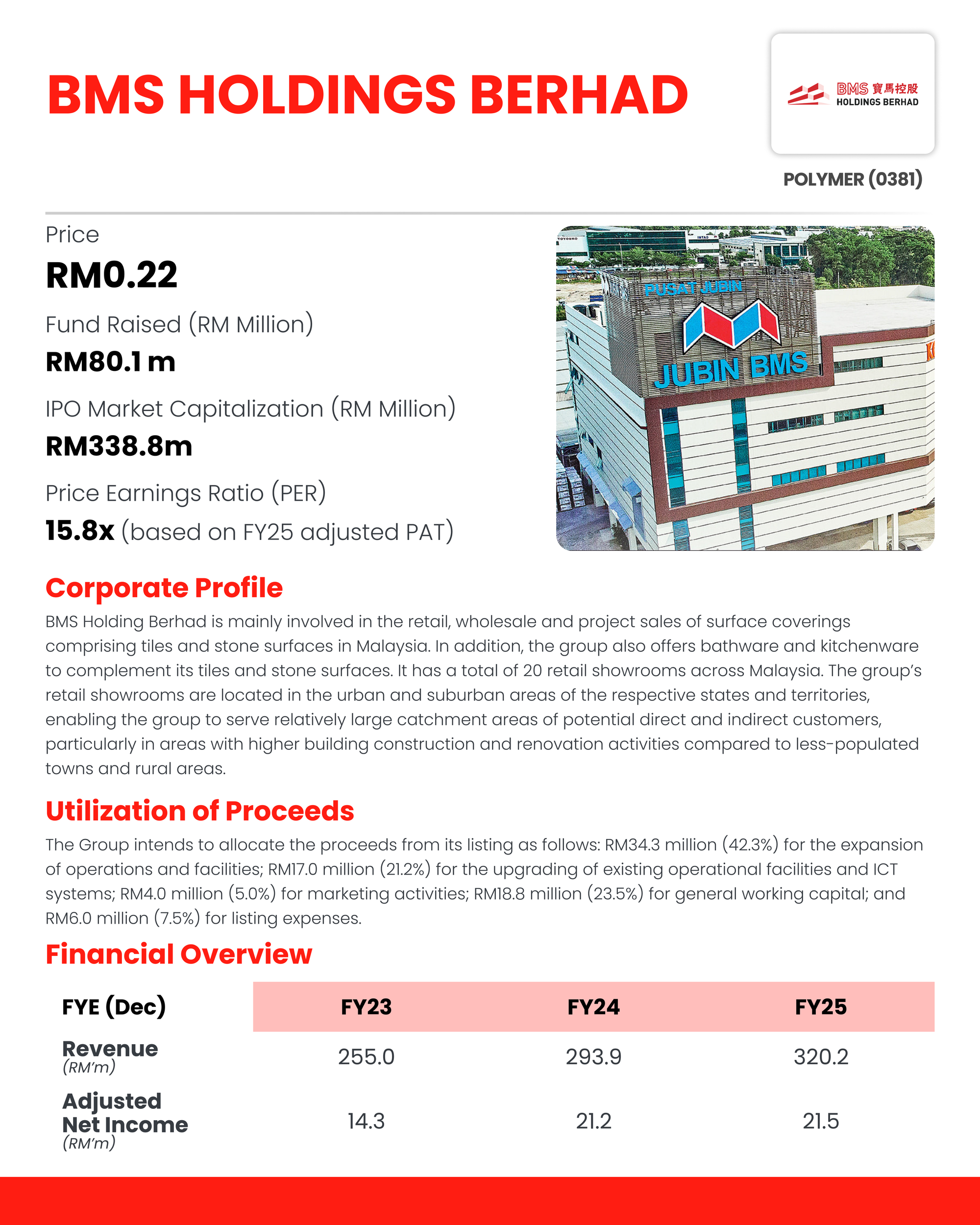

BMS Holding Berhad plans to expand its operations by setting up six additional retail showrooms, a new Seremban retail showroom and five new retail showrooms in the Klang Valley, to build on the group’s existing brand awareness and track record of its presence to provide more convenience and access for potential customers. The total cost of setting up the new retail showrooms is estimated at RM47.00m; RM13.00m will be funded through IPO proceeds, and the remainder will be internally generated funds and/or bank borrowing.

- Setting up a new distribution centre

BMS Holding Berhad plans to set up a new distribution centre in the Klang Valley on the back of its revenue growth, as well as to support its showroom expansion strategies in the central region. The location has yet to be identified by the group. The group plans to complete the construction or acquisition of the distribution centre by 2027, and it expects to commence operations in 2028. The total cost of setting up the new distribution centre is estimated at approximately RM75.00m for the purchase of land, construction, renovation, and interior fit-out works of the proposed distribution centre, or for the purchase of a building. RM14.98m will be funded through IPO proceeds, and the remainder will be internally generated funds and/or bank borrowing.

M+ Fair Value

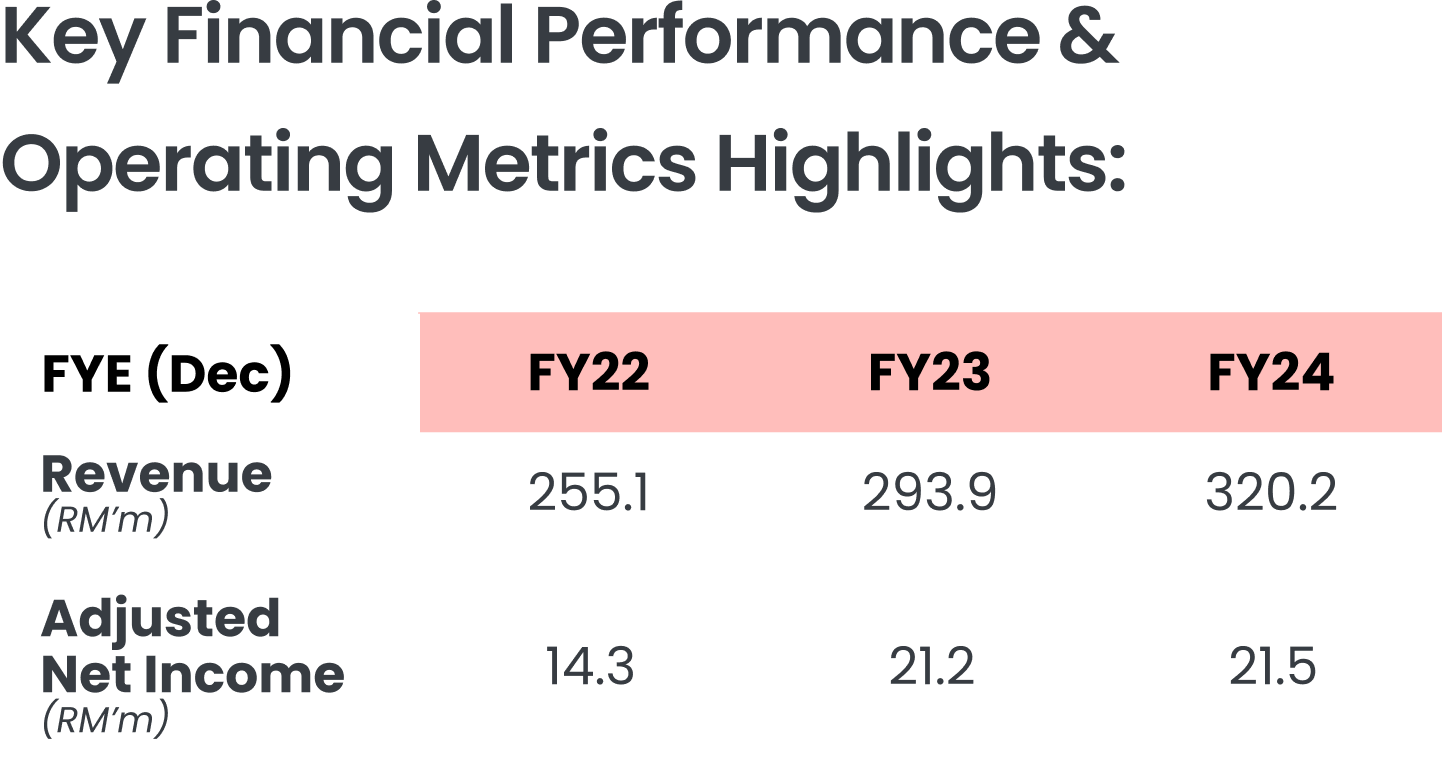

Given that its strong brand recognition stems from its extensive geographical presence, backed by a wide range of offerings, we forecast a 3-year earnings CAGR of 13.0%. We opine the retail segment, which caters to the domestic mass consumer market, specifically for house owners and end users, is experiencing higher demand, driven by optimistic consumer spending. Moreover, we pencil a GPM margin to normalize back to c.33.3-33.6%.

Hence, we ascribed a 15.0x P/E based on its mid-FY27f EPS to arrive at the RM0.25 FV. While the valuation is a 11.8% discount from the Consumer Index 2-year average of 17.0x, we believe it is justified given the Group’s comparatively smaller net margins and market capitalization.