A1 A.K. Koh Group Berhad - Upside Potential of 8.0%

Future Plans for Growth:

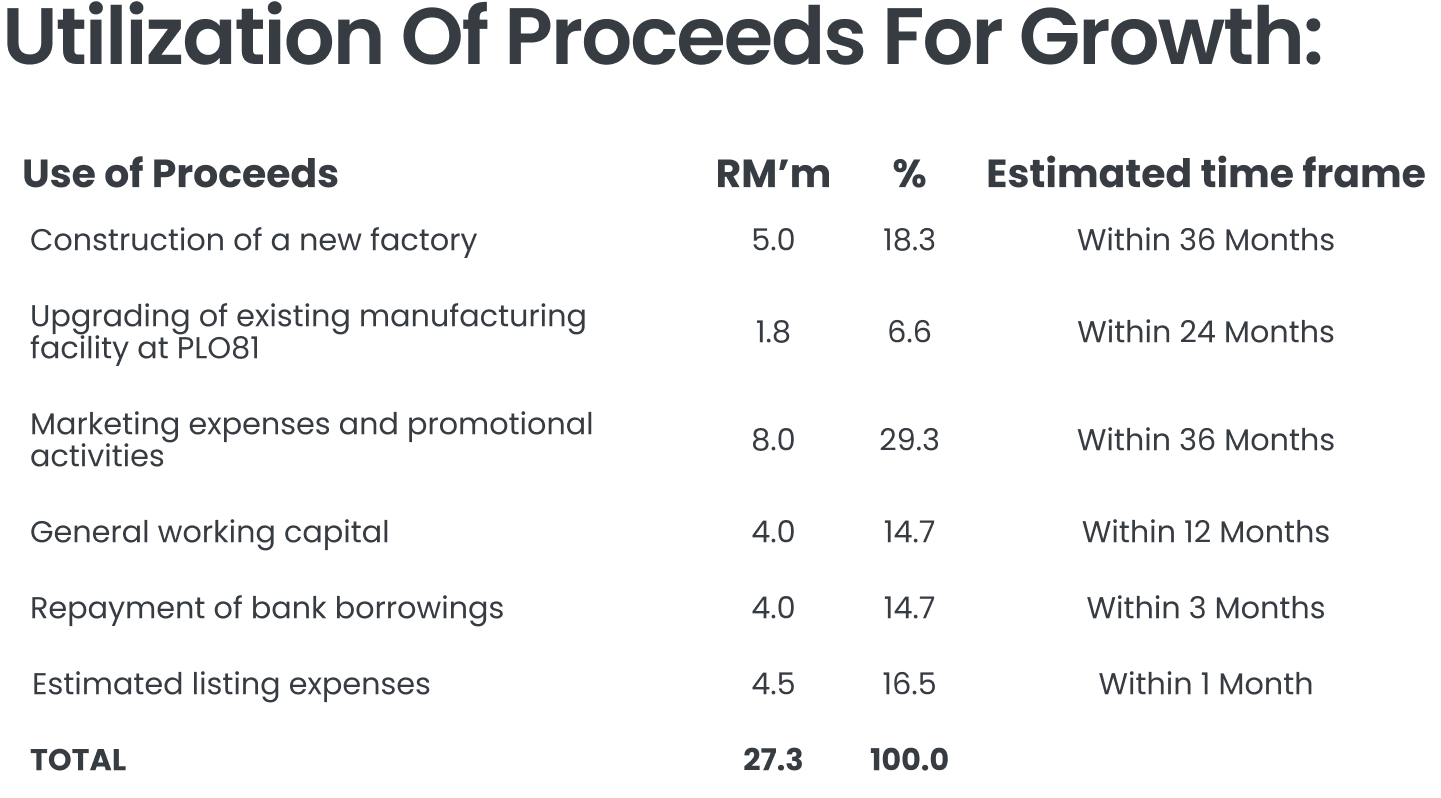

- Construction of a new factory to house more premade pastes production lines.

A1AKK plans to construct a new manufacturing facility adjacent to its existing plant in Senai, Johor to expand production capacity for its premade pastes, in response to growing market demand. The new facility will comprise a 17,000 sqft production floor and a 17,000 sqft storage space, with construction scheduled to begin in 4Q25 and complete by 4Q26. The project is expected to cost RM5.0m, funded via IPO proceeds, while additional machinery amounting up to RM4.0m will be financed through internal funds and/or borrowings. The freehold land has been successfully converted for industrial use as of June 2025, and the semi-automated production line is expected to start operations in Q4 2027, increasing annual production capacity for premade pastes by 100% from 468 tonnes to 936 tonnes.

- Upgrading of existing manufacturing facility.

A1AKK will upgrade its existing manufacturing plant at PLO 81 by automating key production processes to reduce manual handling. RM1.8m from IPO proceeds will be allocated for the acquisition of three new machines: (i) a high-speed packing machine for small seasoning sachets, increasing packing speed by 5x from 30packs/min to 150 packs/min, (ii) a bundle packing machine to automate the packing of instant noodle packets instead of manual packing, and (iii) two retort sterilisation machines to improve food safety through high-temperature steam sterilisation.

- Intensified marketing and promotional campaigns.

A1AKK will allocate RM8.0m from IPO proceeds to enhance brand visibility and drive product awareness across Malaysia and key export markets. The strategy includes (i) expanding product listings at both existing and new distribution points such as convenience stores, retail pharmacies, and petrol kiosks, (ii) on-ground campaigns including promotional displays, product samples, and point-of-sale materials will be ramped up to boost in-store engagement, and (iii) digital marketing efforts through social media platforms including YouTube, Facebook, TikTok, Instagram, and REDnote by collaborating with content creators and livestream hosts. Enhanced activities on Shopee, including livestreams and viewer giveaways, will further strengthen online presence and customer engagement.ions and refreshed corporate branding materials.

M+ Fair Value

We assign a fair value of RM0.27 per share for A1AKK, representing an 8.0% upside from its IPO price of RM0.25. This valuation is based on a P/E ratio of 19.0x, pegged to the mid-FY27F EPS of 1.43 sen. We believe the ascribed P/E is fair, given that its peers in the packaged foods and meats sub-industry under the Bursa Malaysia Consumer Product Index (KLCSU) trade at an average forward P/E and historical P/E of 13.2x to 19.1x.

We ascribed a valuation multiple closer to the higher end of this range because despite having a smaller market capitalisation, A1AKK is able to deliver a relatively stronger ROE and NP margin of 34.0% and 12.4% respectively, compared to its peers' single-digit ROE and NP margin of 9.1% and 3.4%.

Looking ahead, A1AKK’s plans to expand its product availability across new retail channels like convenience stores, petrol kiosks, and retail pharmacies, along with intensified promotional activities in high-traffic locations such as supermarkets and hypermarkets, are expected to drive nationwide market share expansion, reinforcing our support for its upside-tilted valuation multiple.