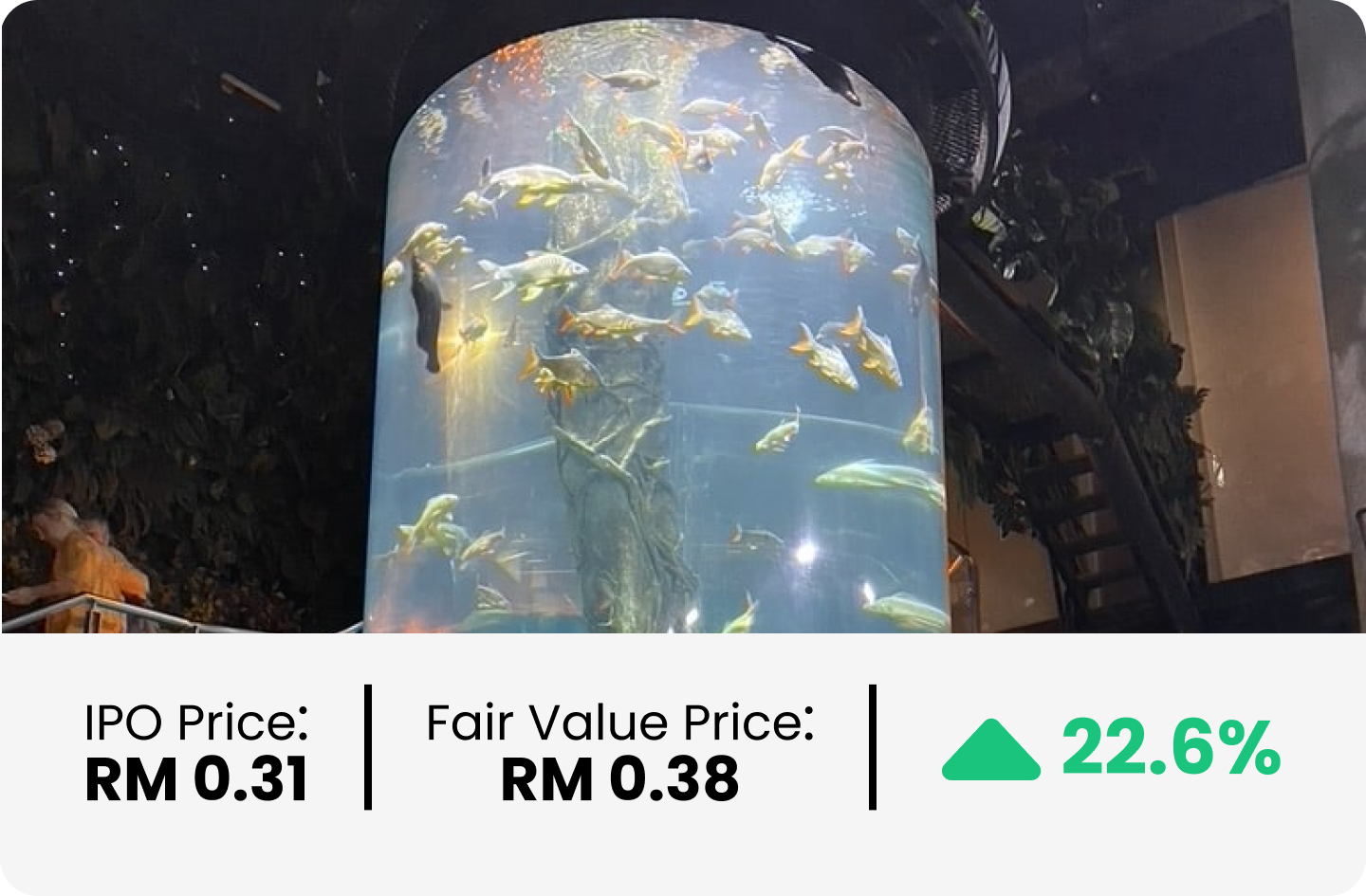

Aquawalk Group Berhad - Upside Potential of 22.6%

Future Plans for Growth:

- Upgrade and expand existing aquaria

Aquawalk Group Bhd intends to upgrade and develop new attractions in Aquaria KLCC. The group plans to utilize RM12.2m from proceeds from public issues to enhance and upgrade Aquaria KLCC’s infrastructure and facilities, as well as introduce new attractions to improve the overall visitor experience. Moreover, the group also plans to develop new attractions for Aquaria Phuket. A total of RM20.7m will be utilized for the new attraction at Aquaria Phuket to further introduce or augment its attractions.

- Invest in new projects to increase its market share within the aquariums industry

Aquawalk Group Bhd has entered into a non-binding MOU with Qhazanah Sabah Berhad in 2024 to jointly develop an oceanarium in Kota Kinabalu. As this is expected to be a 60:40 joint venture between Aquawalk Malaysia and Qhazanah, Aquawalk Malaysia’s 60.0% share of the cost is estimated to be RM42.3m (RM39.6m of which will be funded from proceeds raised through the IPO). Moreover, the group intends to collaborate with a developer of a leading recreational theme park complex in Java, Indonesia, to develop an aquarium (“Indonesia Project”). Subject to further negotiations, this collaboration is expected to be a 60:40 joint venture between Aquawalk Malaysia and the developer. Thus, Aquawalk Malaysia’s 60.0% share of the estimated cost of the project is RM17.3m.

M+ Fair Value

M+ Fair Value

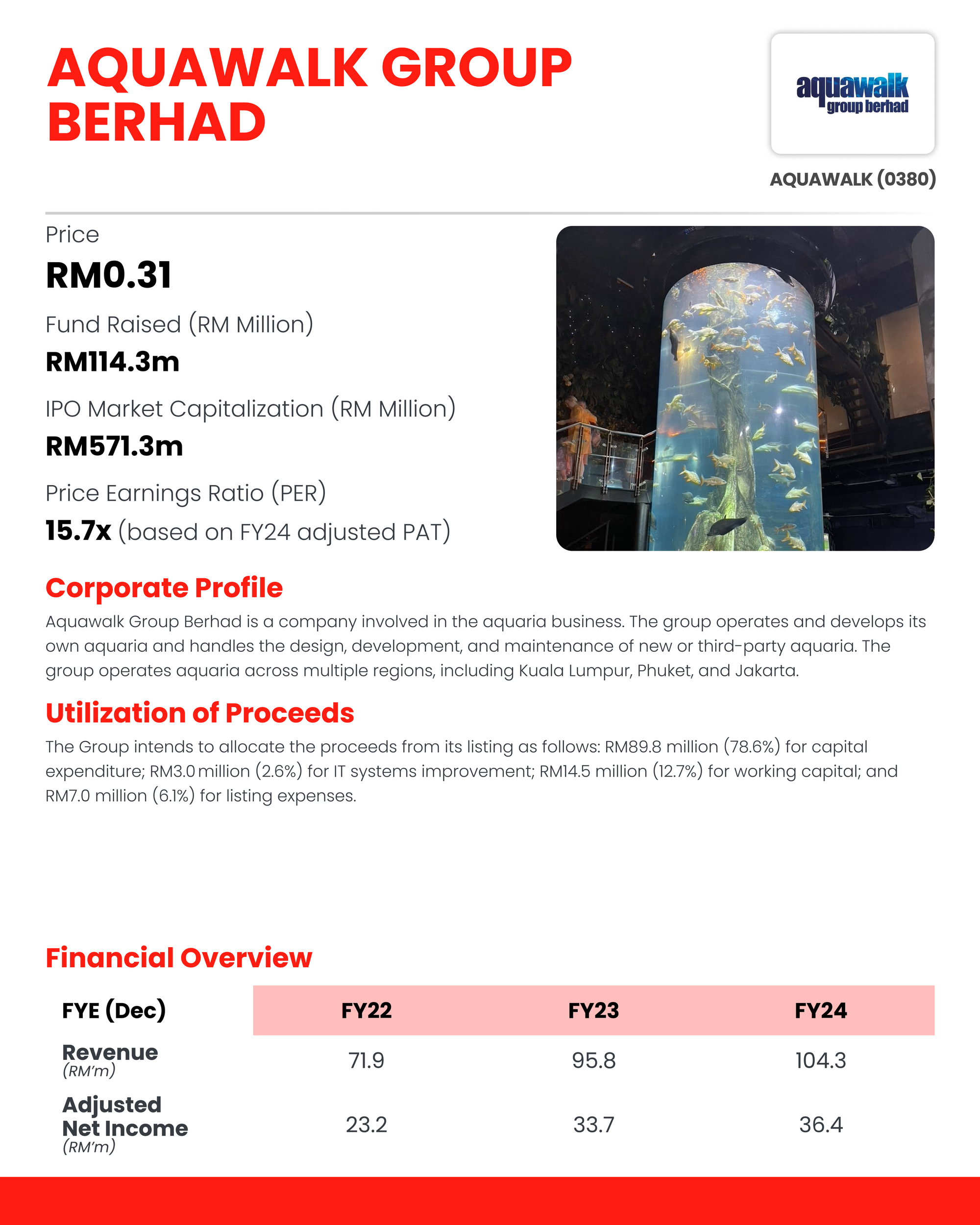

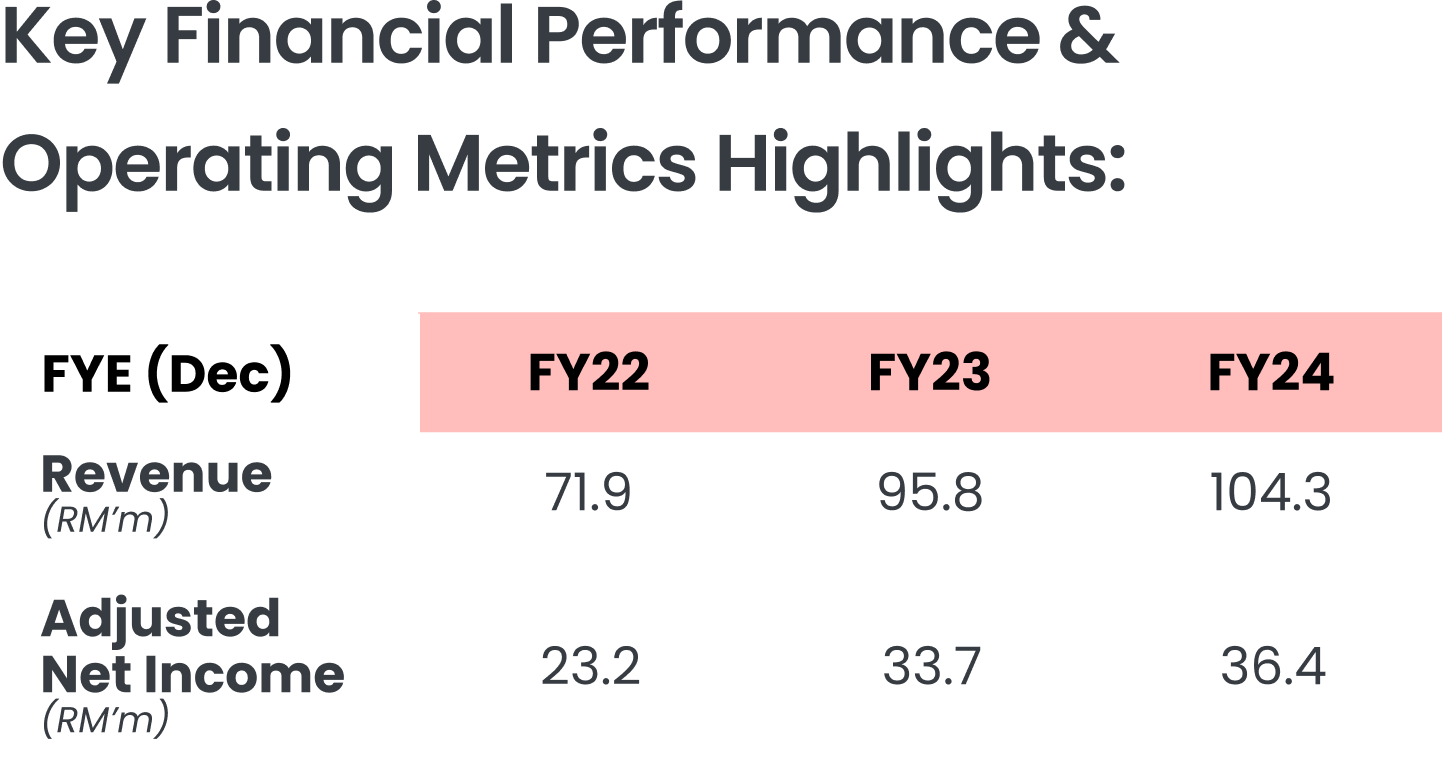

We assign a fair value of RM0.38 per share for AQUAWALK, representing a 22.6% upside from its share price of RM0.31. This valuation is based on a P/E ratio of 18.0x, pegged to the FY26 EPS of 2.13 sen.

We believe the ascribed P/E multiple is fair, given that the average 12-months forward P/E and historical P/E multiples of its peers at the Bursa Malaysia Consumer Discretionary sector stood at 17.8x to 31.5x.